GST Council to decriminalise certain offences, runs out of time to discuss tax evasion in pan masala business

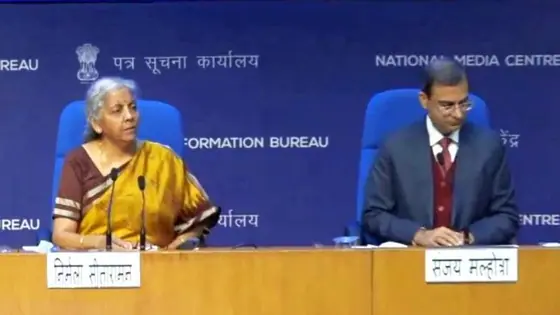

'For criminal offence defined under the GST laws, the limit has been increased from Rs 1 crore to Rs 2 crore for all offences barring those involving fake invoices,' Revenue Secretary Sanjay Malhotra said.

The Goods and Services Tax Council on Saturday decided to double the threshold for launching prosecution to Rs 2 crore and decriminalise certain offences, Revenue Secretary Sanjay Malhotra said.

'For criminal offence defined under the GST laws, the limit has been increased from Rs 1 crore to Rs 2 crore for all offences barring those involving fake invoices,' Malhotra told media persons.

Also Read: It will be India's century, predicts venture capital genius Brendan Rogers

'To reduce the workload of courts, the compounding amount has been decreased from 50 per cent to 150 per cent of the tax amount. This has been reduced to 25 per cent,' he added.

Finance Minister Nirmala Sitharaman said that the Council could only decide on eight out of the 15 agenda items due to a shortage of time. Among the subjects that could not be discussed included mechanisms to curb tax evasion in pan masala and gutka businesses and setting up of appellate tribunals for GST.

Sitharaman clarified that no new taxes had been brought on the deliberations at the GST Council's 48th meeting.

According to Malhotra, the issue pertaining to GST on online gaming and casinos could not be discussed as the report prepared by a Group of Ministers (GoM) chaired by Meghalaya Chief Minister Conrad Sangma on the issue was submitted only a few days back.

In fact, the GoM report was not even circulated among GST Council members.

The GST Council, headed by the Union Finance Minister, is the highest decision-making body of the one-nation, one-tax GST regime and includes representation from all states and Union Territories.