Proposed amendments to the GST laws, upon parliamentary approval, are scheduled to become effective from October 1. This strategic decision is a culmination of comprehensive discussions spanning a period of approximately three years.

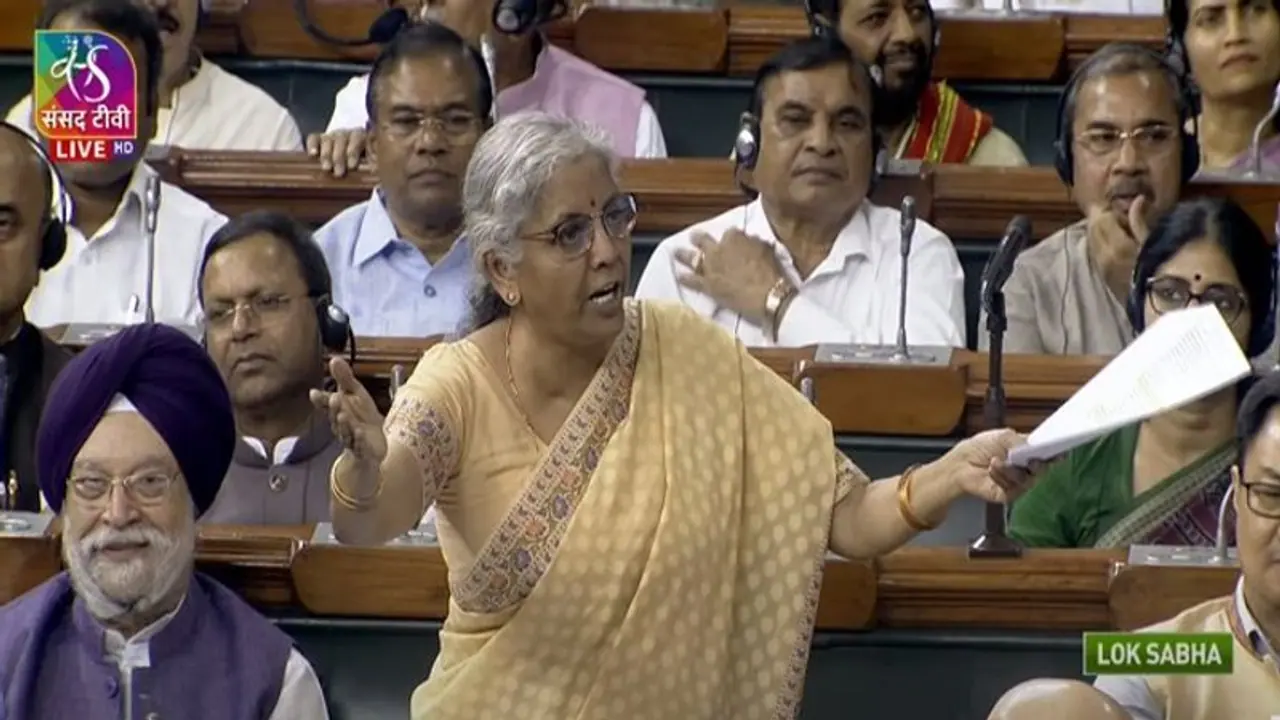

In a significant move, Union Finance Minister Nirmala Sitharaman on Friday (August 11) presented the Central Goods and Services Tax (Amendment) Bill, 2023. The central government is strategically advancing a bill within the Lok Sabha that proposes the application of a 28 percent Goods and Services Tax (GST) to encompass online gaming, casinos, and horse racing.

Proposed amendments to the GST laws, upon parliamentary approval, are scheduled to become effective from October 1. This strategic decision is a culmination of comprehensive discussions spanning a period of approximately three years. A specialized Group of Ministers (GoM), assembled by the GST Council, diligently undertook a thorough evaluation process, involving site visits and consultations with diverse industry stakeholders, according to statements from the Finance Ministry.

The imminent amendment to the Central Goods and Services Tax Act is poised to clear the path for the implementation of a 28 percent Goods and Service Tax (GST) applied to the nominal value of initial bets placed on online gaming platforms, casinos, and horse racing.

Currently, the online gaming sector and select horse racing clubs adhere to an 18 percent GST rate on platform fees/commissions, which range between 5 and 20 percent of the overall nominal value. Meanwhile, certain horse race clubs face a 28 percent levy on the complete nominal value. Disputes regarding the 28 percent tax on actionable claims within betting and gambling are being contested across legal channels. Concurrently, casinos are presently subject to a 28 percent GST on Gross Gaming Revenue (GGR).

We followed Supreme Court order: Centre on Bill on appointment of Election Commissioners