GST Council imposes 28 per cent tax on online gaming, horse racing, and casinos, aiming to bring them under the purview of GST framework.

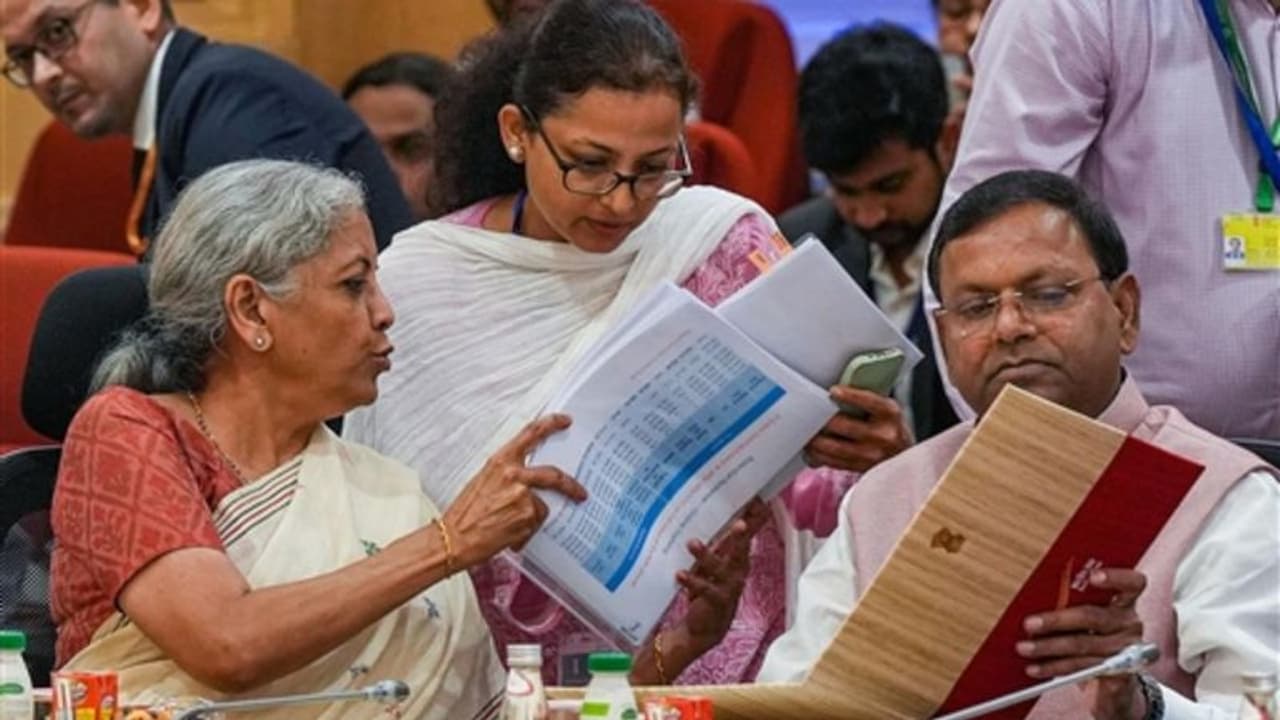

In a significant development, the Goods and Services Tax (GST) Council, chaired by Finance Minister Nirmala Sitharaman, has announced its decision to levy a 28 per cent tax on the turnover of online gaming companies, horse racing, and casinos. The council, which includes representatives from all states and Union Territories (UTs), arrived at this tax rate after considering the recommendations made by a group of ministers responsible for assessing the taxation of casinos, horse racing, and online gaming. This move is aimed at ensuring appropriate taxation in these sectors and bringing them under the purview of the GST framework.

Key things to get cheap after 50th GST Council Meet:

Cancer treatments and medications for uncommon diseases are exempt from GST tax by the GST Council.

GST Council exempts private operators' satellite launch services from GST.

GST reduction from 18 to 5 percent for uncooked, unfried snack pellets

GST in fish soluble paste is being reduced from 18 per cent to 5 per cent

GST on fake Zari thread is being reduced from 12 to 5 per cent

GST on LD slag is being reduced from 18 per cent to 5 per cent

Key things to be costlier after 50th GST Council Meet:

According to FM Sitharaman following the GST Council meeting, a 28 per cent GST will be applied to the whole value of online gambling, horse racing, and casinos.

Currently, an SUV must meet four criteria in order to be subject to the imposition of a cess: it must be commonly referred to as an SUV, be at least 4 metres long, have an engine with a displacement of 1,500 cc or more, and have a minimum 170 mm of unloaded ground clearance.

According to her, the SUV will henceforth only be defined by its length (4 metres and up), engine size (1,500 cc and up), and ground clearance (170 mm and above).