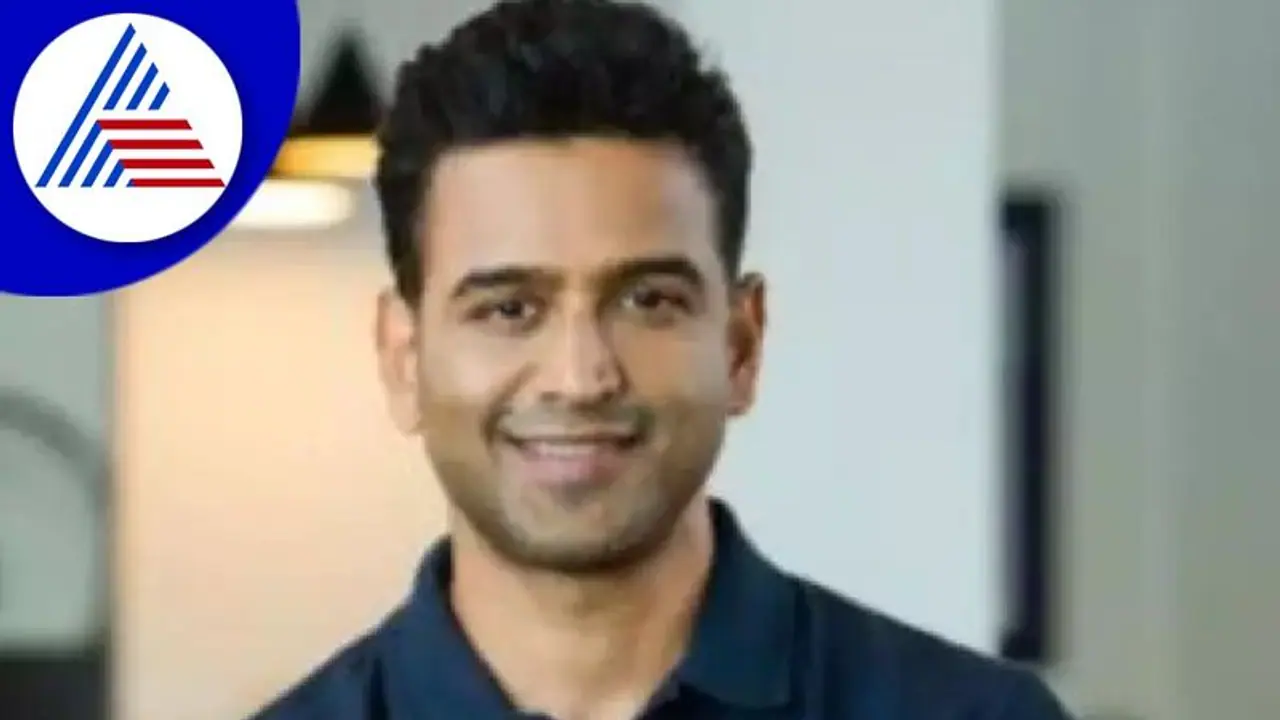

Zerodha co-founder Nithin Kamath recently shared five tips for Gen Z and millennials to evade "retirement crisis". "Retirement crisis will probably be the biggest problem for most countries 25 years from now," Zerodha co-founder Nithin Kamath said.

Nithin Kamath, co-founder of the online brokerage company Zerodha, has given millennials and members of Generation Z some advice on how to save money for their post-retirement years. He said that because to technological advancements, the retirement age has been lowered to 50 and the average lifespan has increased to 80.

In a string of tweets, Kamath wrote, "Gen Z and even millennials don't give the retirement age's rapid decline owing to technological advancement and life expectancy's rise due to medical advancement enough thought. Retirement age might be 50 and life expectancy 80 in 20 years. How do you fund the 30 years?

Also Read | Sriram Krishnan temporarily assisting Elon Musk with Twitter; know all about him

In addition, he noted that, if not for climate change, the retirement crisis will likely be the main issue for the majority of nations in 25 years. A retirement fund was built by earlier generations thanks to long-term real estate and stock market bull markets.

So, Kamath advised the youth to stop getting triggered by everyone trying to lend, and stop borrowing to buy things that are not needed or that get depreciated in value.

"Get a jump on saving. Invest in a variety of index funds, G-Secs, and ETFs through SIPs. The greatest option to outperform inflation over the long run is still probably stocks. Get a family health insurance plan that covers everyone in the family as well as yourself," he said.

Also Read | Jeff Bezos' wealth on verge of $23 billion drop, one of worst on record

Further suggesting, Kamath wrote: "Most people can become financially ruinous or have a significant financial setback with just one health event. One insurance outside of what is offered at work is necessary since jobs don't endure forever."

The co-founder of Zerodha added that if you have dependents, they should be taken care of in the event of your death. Purchase a sufficient term insurance coverage. In the worst-case scenario, the funds in their bank FDs (fixed deposits) should be sufficient to meet their necessities.