Even though the last quarter (January 2022-March 2022) growth of the financial year 2021-22 was the lowest for the year, it has shown a silver lining for the Indian economy for two reasons, say experts

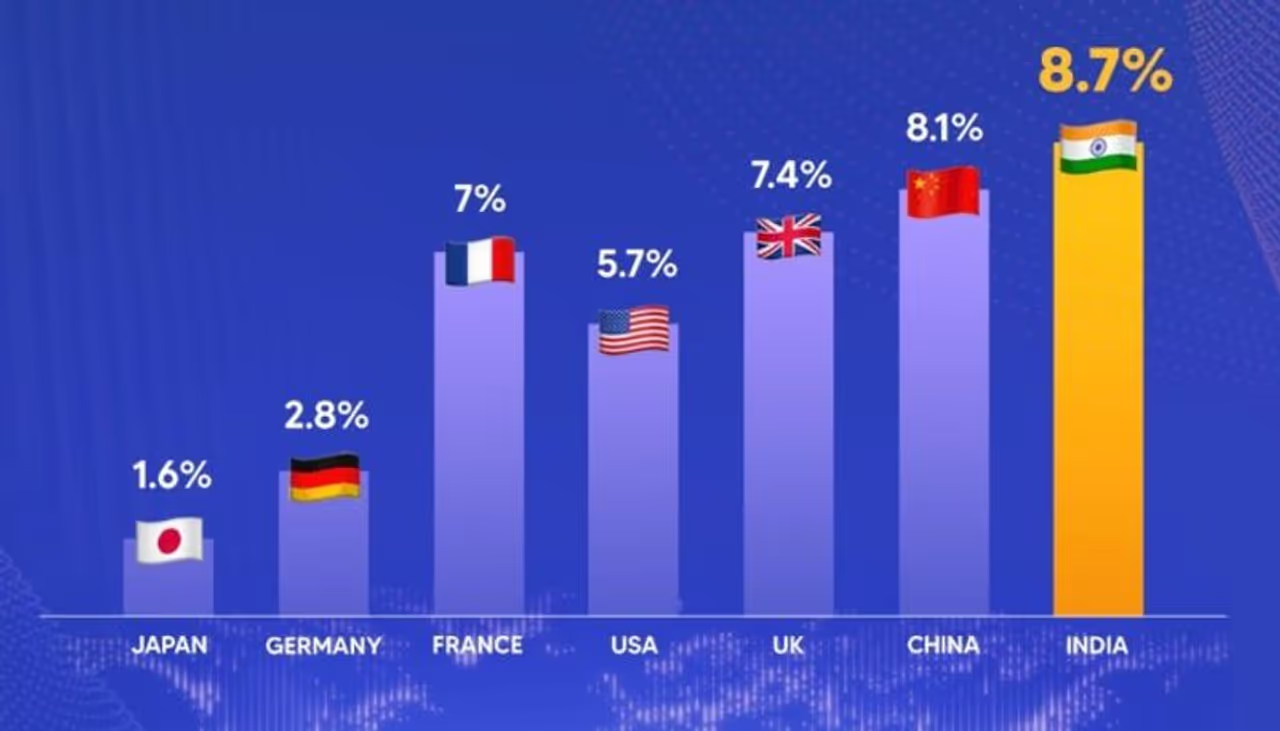

India reported a Gross Domestic Product growth of 8.7 per cent in 2021-22 as compared to a contraction of 6.6 per cent in the last fiscal. However, the officially estimated figure was 8.9 per cent for this year's growth. The data was released by the National Statistical Office on Tuesday.

Also Read: E-commerce sites under Govt scanner over fake reviews

The GDP growth in the fourth quarter that ended on March 31 reported a dip of 4.1 per cent against 5.4 per cent in the previous quarter same year, while in the corresponding quarter last year it stands at 2.5 per cent.

What is GDP?

The term 'GDP' is defined as the total value of all the goods and services produced within the territorial boundary of a country in a year.

Why is GDP important?

It provides data about the size of the economy and how an economy is performing. The growth rate of real GDP is often used as an indicator of the general health of the economy. In broad terms, an increase in real GDP is interpreted as a sign that the economy is doing well.

What do experts have to say about the GDP number?

Prakash Chawla

Economic Expert

Inflation is certainly taking its toll on India's GDP growth, as is evident from a sharp difference between the trajectory at constant prices (after factoring in inflation) and current prices (without deflating the inflation).

In simple words, while real economic growth (after adjusting for inflation) for the fourth quarter of the financial year 2021-22 was just about 4.1 per cent, it was more than three times higher at 15.2 per cent without factoring in inflation.

Likewise, the growth rate for the entire fiscal of 2021-22 was 8.7 per cent at constant prices, whereas it shot up by 19.5 per cent. This is all because of inflation which is filling in government coffers, though expenditure pressure is also mounting.

High inflation also results in higher taxes for the exchequer. This is also seen in a big rise of 32.8 per cent in net taxes on products at current prices for FY'22. The price rise has crept into the entire supply chain of all the products and services, be it food or manufactured items or activities such as mining.

So, inflation remains the number one challenge for the government as also the Reserve Bank of India, which is left with not much of an alternative but to squeeze liquidity from the system and raise interest rates.

Shishu Ranjan,

Vice President, Barclays

Even though the last quarter (January 2022-March 2022) growth of the financial year 2021-22 was the lowest for the year, it has shown a silver lining for the Indian economy for two reasons. One, the actual quarterly growth turned out to be better than expected given that Q4 (Jan-Mar) is seen as a lean period because at least a month is considered inauspicious for buying new high-value commodities whereas high Q3 (Sep-Dec) growth is driven by increased consumption expenditure due to Indian festive season.

Two, the government expenditure was muted in Q4 due to the model code of conduct in place for 5 states where legislative assembly elections were due and this suppressed quarterly GDP growth. Given these two constraints are absent in the Q1 of FY 22-23, the GDP growth rate will increase and that's the silver lining.

The manufacturing sector recorded contraction though, but this should be an exception in a quarter marred by the 4th global wave of Covid-19 and the ongoing war between two industrial nations impacting the global supply chain of manufacturing industries.

Additionally, the brighter side is reflected in investment expenditure which grew by more than 5% and is confirming investor's confidence in the Indian economy at a time when the global economy is facing acute challenges due to trade disruption owing to the Russia-Ukraine war and severely high inflation resulting out of supply constraints as well as liberal monetary policy of central banks across globe in order to provide high liquidity for economic recovery from Covid-19 recession.

Despite these challenges, India has become the fastest-growing economy registering 8.7% growth in FY 2021-22 and FY 2022-23 is expected to be better based on three factors. One, the budgetary capital expenditure has increased by 35.4%. Two, the private investment expenditure has increased by 78% with respect to the pre-pandemic level and increased government budgetary outlay is expected to further drive this up.

Lastly, the monsoon is predicted to be normal and that is good news for consumption expenditure as well as manufacturing growth. All three combined are expected to keep India as the fastest growing economy in the current fiscal too.

Also Read: Rs 2000 notes now 1.6% of total currency notes in circulation