Hindenburg's last report had sent Adani Group shares into a whirlwind, and saw Gautam Adani's personal wealth eroding massively following allegations that it engaged in accounting fraud and stock manipulation.

Two months after triggering a super-cyclone of sorts in the Indian financial markets with its damning allegations against Gautam Adani and his Adani Group, Hindenburg Research is all set to release another report.

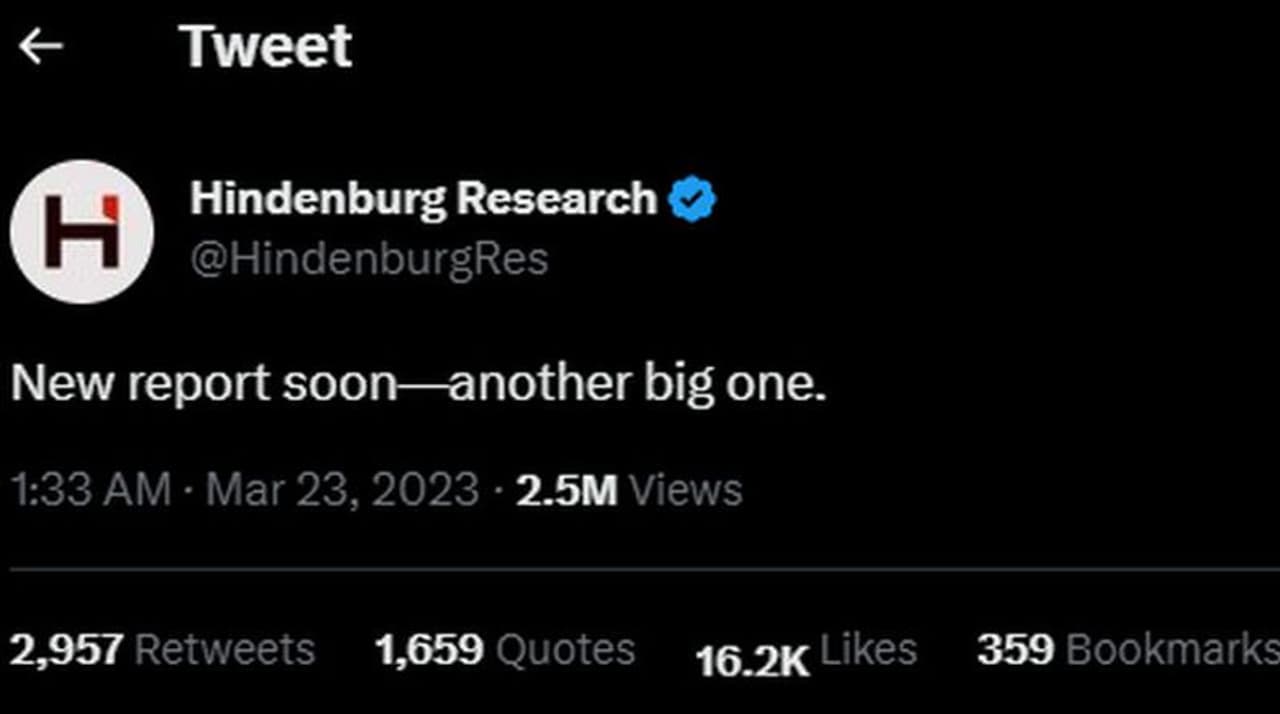

The US short-selling firm dropped a Twitter message, saying: 'New report soon -- another big one.' The New York-based research firm's latest tweet didn't specify the timing of the next report's release. But it did spark speculation about the next target of Hinderburg Research.

While many users speculated that the report could be about another top Indian billionaire businessman, others believed that it could be about the ongoing banking crisis in the United States.

Hindenburg's last report had sent Adani Group shares into a whirlwind and saw Gautam Adani's personal wealth eroding massively following allegations that it engaged in accounting fraud and stock manipulation.

The report had multiple allegations against the Gautam Adani-led group, including fraudulent transactions, . In the report, Hindenburg alleged that Adani's brother Vinod 'manages a vast labyrinth of offshore shell entities' that move billions into group companies without required disclosure. The report called out the conglomerate's alleged 'substantial debt', which includes pledging shares for loans, and claimed that the Group's auditor 'hardly seems capable of complex audit work'.

The Adani Group rejected the allegations but could not prevent a bloodbath at the bourses.

What does Hindenberg Research do?

Hindenburg engages in activist short selling, which involves selling borrowed stocks in hopes of buying at a lower price later. Short sellers make a killing If prices fall expectedly. Hindenburg makes bets based on its research, which takes into account 'man-made disasters' like undisclosed related-party transactions, accounting irregularities and mismanagement.

It especially looks for illegal/unethical business or financial reporting practices; accounting irregularities; undisclosed related-party transactions; bad actors in management or key service provider roles; and undisclosed regulatory, product, or financial issues in firms. In the past, Hindenburg has targeted companies like Kandi (China), Nikola Motor Company (US), Lordstown Motors Corp (US), Clover Health (US) and Tecnoglass (Colombia).

The company was founded by 38-year-old Nathan (Nate) Anderson, who lived in Jerusalem before returning to the United States, where he first took up a consulting job with a financial data company FactSet and then worked at broker-dealer firms in Washington, DC and New York. Before he founded Hindenburg, Anderson worked with Harry Markopolos, who had flagged Bernie Madoff's Ponzi scheme, to investigate Platinum Partners, a hedge fund that was eventually charged with fraud worth $1 billion.

With agency inputs