Rattan Dhillon stumbled upon 37-year-old physical share certificates while spring-cleaning his home. Originally purchased in 1988 at Rs 10 each, the shares had grown to 960 due to stock splits and bonus issues over the years.

A Chandigarh resident who found decades-old Reliance Industries Ltd (RIL) share certificates worth Rs 12 lakh has opted not to digitise them, citing complex bureaucratic process. His decision has sparked a debate on social media, with users offering advice and alternative solutions to help him navigate the red tape.

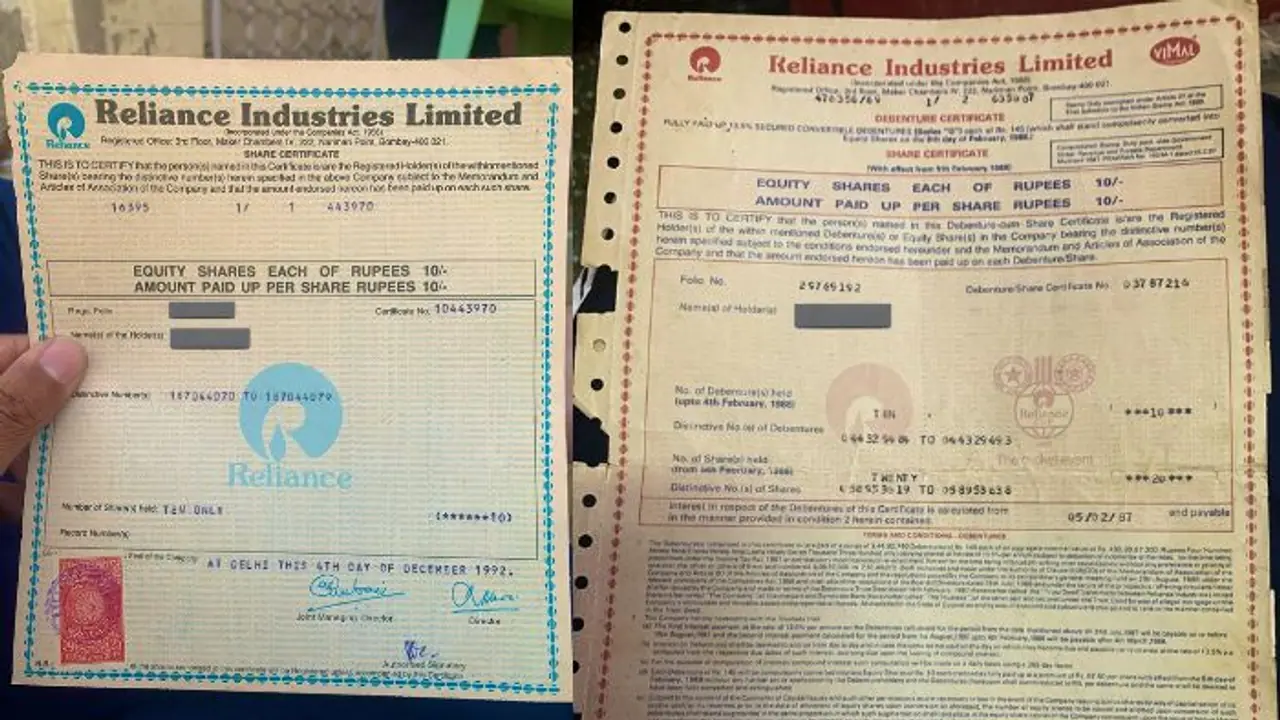

Decades-old share certificates unearthed

Rattan Dhillon stumbled upon 37-year-old physical share certificates while spring-cleaning his home. Originally purchased in 1988 at Rs 10 each, the shares had grown to 960 due to stock splits and bonus issues over the years. Excited by his find, Dhillon initially explored the process of digitising them.

Also read: Jio Airfiber leads 5G FWA boom: 85% of 2M new connections in Q3 belong to Reliance Jio

Cumbersome process forces Dhillon to abandon digitisation

However, after learning about the extensive paperwork required—including a legal heir certificate, a succession certificate, and clearance from the Investor Education and Protection Fund Authority (IEPFA)—Dhillon decided against pursuing digitisation.

"It seems Dhirubhai Ambani's signatures will go to waste, as I've decided not to proceed with digitizing the shares," he posted on social media. "The process is just too lengthy—obtaining the legal heir certificate alone takes 6-8 months, and the IEPFA process reportedly takes 2-3 years. I don't see the value in investing so much time. India really needs to streamline its paperwork."

For now, Dhillon has chosen to retain the physical share certificates rather than engage in the lengthy bureaucratic process.

Social media users urge him to reconsider

His decision triggered a wave of responses on X (formerly Twitter), with many urging him to reconsider. Some users contested the timeline he mentioned, arguing that the IEPFA process takes only a few months. "For that amount, a little running around should be fine, I guess," one user remarked.

Others suggested outsourcing the work. "Hire a professional, split the money 50-50, and let them handle the paperwork," a commenter proposed.

Some users pointed out that Dhillon might be underestimating the total value of his shares. "Legal heir certificate will take one week, IEPF will take six months. Plus, Reliance issued bonuses over the years, so there may be more shares than you think. Check with KFintech to verify your holdings," one person advised.

Also read: BSNL ramps up 4G expansion: 1 lakh towers planned by 2025 to rival Jio and Airtel

Frustration vs. practical solutions

While some sympathised with Dhillon's frustration, sharing their own experiences with tedious paperwork, others insisted the process was not as difficult as he believed.

"It took me six months to digitize 200 physical shares in my name, so I understand your hesitation," a user commented. Another countered, "Whoever told you those timelines is wrong. Hire a company secretary and a lawyer—they’ll do everything while you sit at home."