The Reserve Bank of India (RBI) on Wednesday kept key interest rates on hold and maintained an accommodative policy stance to nurture a fragile economic recovery amid a sharp new wave of Covid-19 cases.

Reserve Bank of India (RBI) has kept the policy rate unchanged at 4% and voted unanimously to maintain the status quo with an accommodative stance. The reverse repo rate remained unchanged at 3.5%, and marginal standing facility and bank rate kept unchanged at 4.25%.

Alongside the RBI announced a Rs 1 lakh crore programme to buy government bonds from the secondary market, in addition to the purchases under open market operations.

In a move to boost payments space, RTGS and NEFT facilities will be extended to digital payments intermediaries, beyond banks.

It also extended the National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) facilities to digital payments intermediaries. Till now, only banks were allowed to use RTGS and NEFT payments facility. The central bank also increased the maximum end of day balance for payment banks to Rs 2 lakh from Rs 1 lakh.

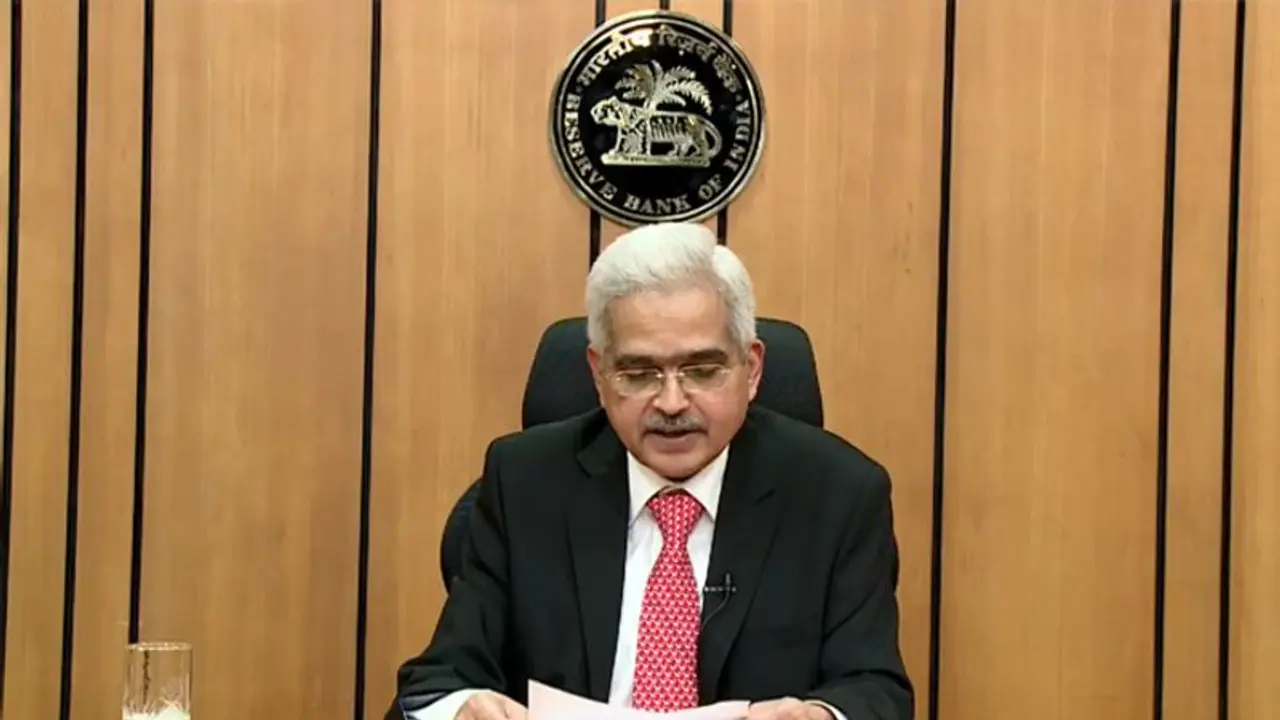

The Monetary Policy Committee (MPC) kept its estimate for economic growth unchanged at 10.5% for the current fiscal, RBI Governor Shaktikanta Das said.

MPC saw inflation edging up to 5.2% in the first half of the new fiscal from 5% in the January-March period and moderate to 4.4% in Q3 of FY22.

While headline inflation at 5% in Feb 2021 remains within the tolerance band, some underline constituents are testing the upper tolerance level. Das said there has been some respite from the incidence of domestic taxes on petroleum products through coordinated actions by the Centre and states could provide relief on top of the recent easing of the international crude prices.

“Recent surge in Covid-19 infections has created uncertainty over economic growth recovery. Focus should be on containing fresh infection spread and economic revival. Prospects to FY22 have strengthened with vaccination programme,” Das said.

The Rs 50,000 crore liquidity injection to the financial institutions, which includes Rs 10,000 crore to NHB, will propel lending in the affordable housing segment. The extension of on-tap TLTRO will keep the additional liquidity window open for the lenders, which is also a reassurance of sustained liquidity in the system.