The government has made new amendments on the use of PAN cards. Here is the list of 20 transactions which cannot be made without the PAN card.

Add Asianet Newsable as a Preferred Source

Permanent Account Number (PAN) is a code that acts as an identification for Indian nationals, especially those who pay the Income Tax. It is a unique, 10-character alpha-numeric identifier, issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. Here are the 20 transactions for which PAN is compulsory:

- Immovable property:

- Sale and purchase of immovable property above ₹5 lakh.

- (New amendment) Stamp duty fees for properties above ₹10 lakh.

- (New amendment) In case of joint property PAN number of each party.

- Vehicle purchase

- Purchase and sale of all vehicles except two wheeler.

- Time deposit

- Time deposit of above ₹50,000 in nationalised banks

- (New amendment) Deposits in cooperative banks, mutual funds and NBFCs (Non Banking Financial Companies)

- Post offices

- All deposits and transactions above ₹50,000

- Sale/purchase of secured property

- All purchases/sales of secured properties above ₹1 lakh

- Bank Account

- Opening of all kinds of accounts except basic savings bank account

- BSNL/mobile connection

- For the new connection of BSNL/Mobile phone

- Hotel/Restaurant bills

- Bills that exceed ₹25,000

- (New amendment) Cash payment of above ₹50,000

- Bank Draft/Pay Order/Bankers cheque

- For amount above ₹50,000

- (New amendment) For transaction above ₹50,000 in a single day.

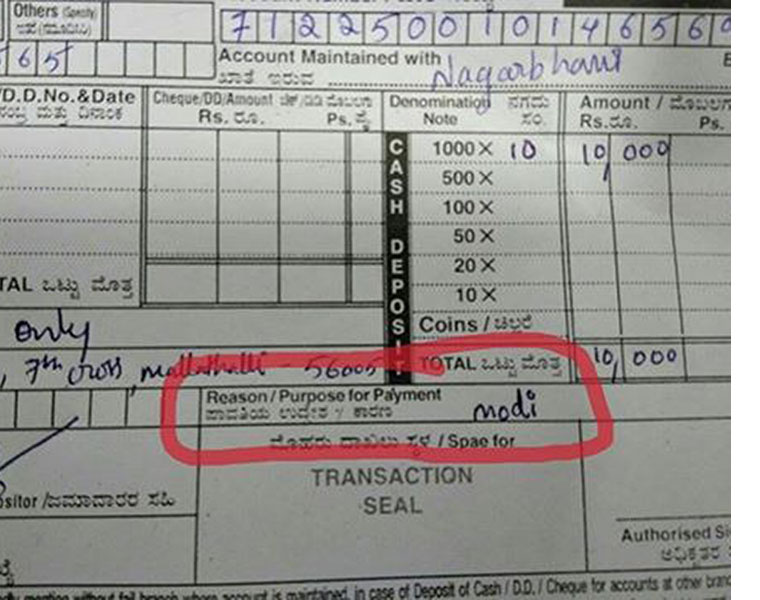

- Bank cash deposit

- Cash deposit above ₹50,000 at a time

- (New amendment) Cash deposit above ₹50,000 in a single day

- Foreign tour

- Cash payment of above ₹25,000

- (New amendment) Cash payment of above ₹50,000 and exchange of foreign currency.

- Credit card

- While applying for a credit card in Nationalised banks/companies/institutions.

- Not applicable for cooperative banks

- Mutual Funds units

- Payment/purchase of above ₹50,000

- Company shares

- Purchasing of shares above ₹50,000

- (New amendment) Opening of Demat account

- (New amendment) For every sale/purchase of shares above ₹1 lakh.

- Bonds/Debentures

- Payment of above ₹50,000

- RBI Bonds

- Payment/possession of RBI bonds of above ₹50,000

- LIC premium

- Payment of premium of above ₹50,000 per annum.

- Purchase of bullion

- Payment of bills of above ₹50,000

- Sale/purchase of commodities

- Sale/purchase of commodities above ₹2 lakh

- Cash credit/prepaid/settlement act

- Payment above ₹50,000 per annum