Nasdaq’s latest reconstitution left Strategy untouched despite multiple high-profile removals.

- Nasdaq removed six companies from the benchmark, including Biogen, Trade Desk, and On Semiconductor, while adding six new constituents.

- The news comes as Strategy’s index status has intensified following MSCI’s review of how digital asset treasury companies are classified.

- The company has never been included in the S&P 500 despite ranking among the 250 most valuable U.S. public companies.

Strategy (MSTR) remained in the Nasdaq 100 following the index’s annual reconstitution, even as index providers face growing pressure to reassess how companies with crypto-heavy balance sheets are treated.

Scrutiny has intensified after MSCI launched a review of digital asset treasury companies (DATs) and their eligibility for inclusion in its benchmarks.

MSTR’s stock edged 0.1% higher in after hours trade on Sunday after a 3.74% drop in the previous session. Meanwhile, the Nasdaq-100 tracking ETF, Invesco QQQ Trust Series 1 (QQQ), fell 0.13%. On Stocktwits, retail sentiment around MSTR and QQQ trended in ‘bearish’ territory over the past day.

Bitcoin (BTC) meanwhile dipped below the $90,000 mark on Sunday night. BTC’s price edged 0.6% lower in the last 24 hours, with retail sentiment on Stocktwits remaining in the ‘bearish’ zone.

Nasdaq 100 Index Changes

Nasdaq said it removed Biogen (BIIB), CDW Corporation (CDW), GlobalFoundries (GFS), Lululemon Athletica (LULU), On Semiconductor (ON), and Trade Desk (TTD) from the tech-heavy benchmark.

New additions included Alnylam Pharmaceuticals (ALNY), Ferrovial (FERF), Insmed (INSM), Monolithic Power Systems (MPWR), Seagate Technology (STX), and Western Digital (WDC). Strategy, which entered the Nasdaq 100 last December under the index’s technology classification, was not affected by the changes.

MSCI Weighs New Rules For Digital Asset Treasuries

The index provider is considering a proposal that would reclassify firms holding more than 50% of their reserves in cryptocurrencies, a move that could result in their removal from MSCI benchmarks. MSCI is expected to decide on the proposal in January.

In a letter to MSCI last week, Strategy stated that its Bitcoin holdings are central to its operating model rather than a passive investment strategy. The company said a fixed 50% threshold is difficult to apply in practice because digital asset values fluctuate with market conditions.

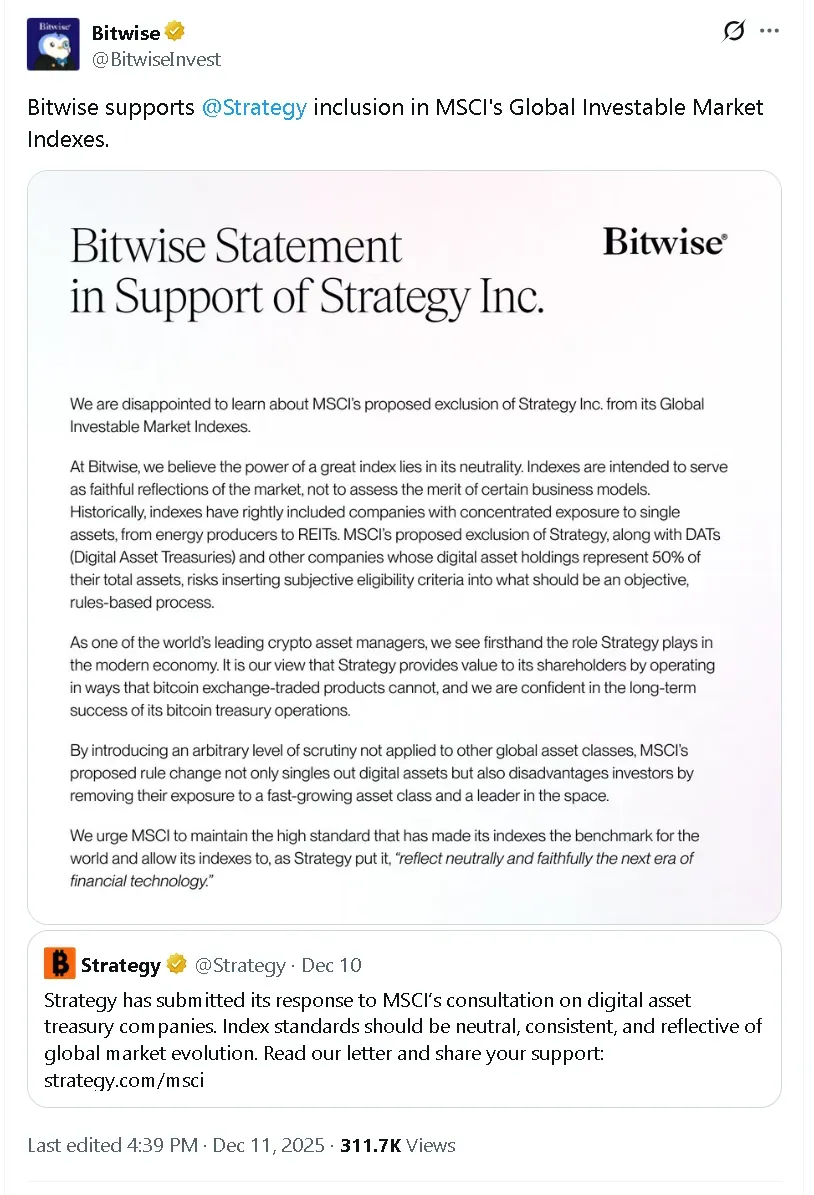

Crypto ETF issuer Bitwise also publicly backed Strategy and DATs, criticizing MSCI’s proposal for introducing subjectivity into what has traditionally been a rules-based process.

S&P 500 Milestone Remains

Strategy pivoted in 2020 from enterprise software to a business model centered on accumulating Bitcoin. The company has since become the most prominent example of a digital asset treasury (DAT) that others like Bitmine Immersion Technologies (BMNR) have followed.

Despite ranking among the 250 most valuable publicly traded companies in the U.S., Strategy has never been included in the S&P 500. The S&P Index Committee has historically avoided companies whose financial profiles are driven primarily by exposure to underlying assets rather than operating cash flows.

Read also: Ethereum Co-Founder Vitalik Buterin Sells Uniswap, KNC, Dogey-Inu In Latest Wallet Move

For updates and corrections, email newsroom[at]stocktwits[dot]com.<