According to analysts, the stock must clear ₹1,060 resistance with volume to sustain bullish momentum.

Paytm posted its first-ever net profit, showing strong business execution. But technical charts are throwing red flags. Shares of One97 Communications, the parent company of Paytm, fell 2% on Wednesday, despite reporting a net profit of ₹123 crore in June quarter (Q1 FY26), a significant turnaround from its ₹840 crore loss in the same quarter last year.

The fintech company recorded a 28% rise in revenues to ₹1,918 crore, and EBITDA turned positive with a ₹72 crore gain.

Paytm's Q1 Performance: Hits & Misses

What Worked: Its focus on cost control and automation led to profitability. The company remains cash-rich with reserves of ₹12,872 crore. Repeat borrowers accounted for over 50% of merchant loans, while indirect expenses, particularly those related to employee stock ownership plans (ESOPs) and marketing, saw notable reductions. And its technological infrastructure, such as QR, Soundbox, and POS devices, remains solid.

Challenges: Revenue growth has stagnated compared to the previous quarter, and the number of monthly transacting users (MTU) has seen a slight dip, along with marketing revenues. Regulatory risks loom large, with show cause notices under FEMA and a ₹5,712 crore GST liability.

Looking ahead, the company aims to increase sales coverage in tier-2 and tier-3 cities, enhance its monetization stack with offerings like loans, equity broking, mutual funds via Paytm Money, and drive AI deployment across customer functions.

Technical Trends

SEBI-registered analyst Rajneesh Sharma noted that the stock broke out of a long-term symmetrical triangle in May 2023 and was now forming a rising wedge, which is a bearish reversal pattern. He identified major resistance at ₹1,050–1,060 for Paytm.

On the downside, he identified key psychological and structural support levels at ₹999, followed by ₹834 (a strong horizontal demand zone). Its Relative Strength Index (RSI) stood at 67.97, showing a bearish divergence.

Sharma remains bearish in the short term, given a likely rejection from the resistance unless it is backed by volume. Over the medium term, he is neutral to mildly bullish and recommends watching ₹999 as the pivot point.

Mayank Singh Chandel flagged that Paytm is trading below a key resistance zone of ₹990–₹1,060. The stock is well above its 200-day Exponential Moving Average (EMA) at ₹823, indicating overall strength. While the momentum is bullish, there is no confirmed breakout yet.

Chandel concluded that this quarter marked a clear shift for Paytm from heavy losses to disciplined, profitable growth. The company is now positioning itself as a comprehensive fintech provider, aiming to monetize its substantial user base more effectively.

But until the stock closes firmly above ₹1,060, it’s wise to stay on the sidelines, according to Chandel. A breakout with volume at this level could signal the start of a new rally.

Analyst Vishal Trehan added that the stock has rallied 122% over the past year, though it is still 53% below its IPO price of ₹2,150.

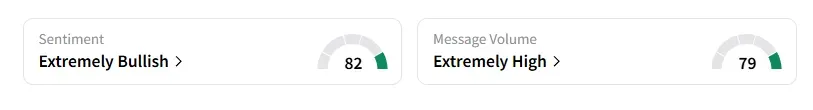

Data on Stocktwits shows that retail sentiment turned ‘extremely bullish’ a day earlier amid ‘very high’ message volumes.

Brokerages Bullish

Jefferies has upgraded Paytm to "Buy" from its earlier rating of "Hold", and raised the target price to ₹1,250 from ₹900, indicating a 19% upside. Citi has also raised its price target to ₹1,215, while maintaining its "Buy" call.

Bernstein maintained its "Outperform" recommendation with a target price of ₹1,100, while Macquarie rated it "Underperform" with a target price of ₹760.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<