JPMorgan flagged falling sales volumes and weaker margins, cutting its full-year earnings forecast to a loss.

- JPMorgan lowered Nio’s price target to $7 from $8, implying a 39% upside from the stock's last close.

- Nio expects adjusted operating profit of 700 million to 1.2 billion yuan in Q4 2025.

- The EV maker is also targeting profitability in its power and battery swap business after reaching 100 million swaps.

Shares of Nio, Inc. drew increased retail buzz early Monday after JPMorgan cut its price target on the stock, even as the company projected its first-ever quarterly operating profit for the fourth quarter (Q4).

JPMorgan Cuts NIO Price Target

JPMorgan lowered Nio’s price target to $7 from $8, implying a 39% upside from the stock's last close, and maintained an ‘Overweight’ rating.

The brokerage said China’s auto industry is likely to underperform in 2026 as underlying passenger vehicle growth turns negative. JPMorgan cited falling sales volumes and weaker margins, and cut its earnings forecast for Nio to a loss for the year despite the company’s projected profitability milestone.

Industry data from the China Passenger Car Association shows China’s passenger NEV wholesale sales in January came in at 900,000 units, up 1% year over year but down more than 42% month over month.

Nio Projects First-Ever Quarterly Profit

Nio said it expects to post its first adjusted operating profit in Q4 2025, based on preliminary unaudited figures. The company forecast adjusted operating profit of 700 million to 1.2 billion yuan ($100.9 million to $172.9 million), compared with an adjusted operating loss of 5.54 billion yuan a year ago. On a GAAP basis, Nio expects operating profit of 200 million to 700 million yuan.

The company said the expected turnaround reflects steady growth in vehicle sales, improved margins driven by a favorable product mix, and ongoing cost-cutting initiatives. In the third quarter, Nio reported a 17% increase in revenue to 21.79 billion yuan, though results missed analyst estimates.

In January, Nio delivered 27,182 vehicles, marking a 96% increase year on year, but down 43.5% from December. Of these, 20,894 were Nio-branded cars and SUVs, 3,481 were Onvo sub-brand vehicles, and 2,807 were Firefly models. Cumulative deliveries reached 1.02 million vehicles.

Despite these gains, Nio warned in September 2025 that the first quarter of 2026 could be weak, as national stimulus policies, including vehicle purchase tax incentives, begin to phase down, calling it an industry-wide challenge.

Nio Targets Power Business Profitability

CEO William Li said Nio has set its next goal as profitability in its power business after completing its 100 millionth battery swap service in early February, according to a report by CnEVPost, citing an open letter by the CEO on the company's mobile app on Monday.

Nio aims to open 1,000 additional battery swap stations in 2026 and start mass construction of fifth-generation swap stations. It has invested more than 18 billion yuan in charging and battery-swapping facilities and has acquired over 2,100 patents over the past 11 years.

How Did Stocktwits Users React?

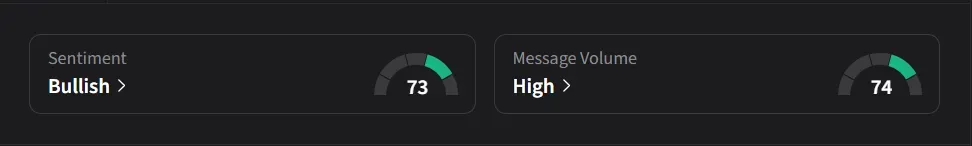

On Stocktwits, retail sentiment for NIO was ‘bullish’ amid ‘high’ message volume.

One user said, JPMorgan’s move to cut Nio’s price target after guiding to its first-ever quarterly profit was “comical.”

Another user said, “Ignore the noise and focus ‘on the shift’. Beginning the journey of profitability for a company is indeed significant, regardless of what some crooked "analyst" think. Going to be a good day. Initiate or add on the cheap.”

U.S.-listed shares of Nio have risen 20% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<