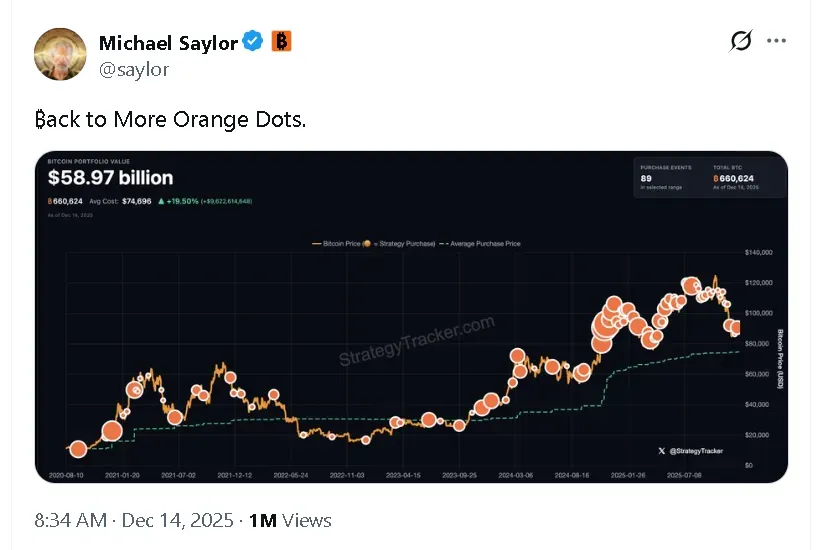

Strategy recently completed its largest Bitcoin buy since late July and remains the largest corporate holder of the apex cryptocurrency.

- The phrase refers to orange markers on Strategy’s treasury charts that denote discrete Bitcoin purchase events.

- The post appeared after Bitcoin dipped below $90,000 during Sunday trading.

- The move comes as Strategy retained its Nasdaq 100 position on Friday amid growing debate over crypto-heavy balance sheets.

Strategy (MSTR) executive chairman Michael Saylor on Sunday revived his closely watched ‘orange dot’ signal ahead of the company’s weekly Bitcoin (BTC) purchase update, typically released on Mondays.

In a post on X, Saylor wrote, “Back to More Orange Dots.” The phrase has become shorthand for Strategy’s Bitcoin buys, referencing the orange markers on the firm’s publicly shared treasury charts that denote each accumulation event.

MSTR’s stock edged 0.1% higher in after hours trade on Sunday. On Stocktwits, retail sentiment around the firm remained in ‘bearish’ territory amid ‘low’ levels of chatter over the past day.

Bitcoin Dips Back Below $90,000

Saylor’s post came as Bitcoin’s price traded below $90,000 in after hours trading on Sunday. The apex cryptocurrency hit a two-week low, as it dipped as low as $87,600, in intra-day trade. Strategy’s Bitcoin purchase last week was its largest since late July of around 10,624 BTC. The firm currently holds 660,624 BTC worth around $58.5 billion at current prices with an average cost per coin of $74,696.

The ‘Orange Dots’ Market Signal

This is not the first time that Saylor has leaned into the symbolism of the orange markers tied to Strategy’s accumulation strategy. In October, he wrote, “The Orange Dots go up and to the right,” in a post attached to the firm’s Bitcoin treasury chart. Days later, he followed up with, “The most important orange dot is always the next.”

Past posts have coincided with sharp market reactions. In early December, a “Back to Orange Dots?” message preceded a rapid Bitcoin rally from below $88,000 to above $91,000 within hours, according to a BeInCrypto report.

Saylor has also used the absence of new dots to signal pauses in buying, writing “No new orange dots this week…” during an October update when the company paused new Bitcoin purchases.

Index Spotlight Returns to Strategy

The renewed focus on Strategy’s Bitcoin strategy arrives alongside broader scrutiny of its place in major equity benchmarks. The company retained its position in the Nasdaq 100 following the index’s annual reconstitution, even as index providers face growing pressure to reassess how companies with crypto-heavy balance sheets should be classified.

Read also: Ethereum Co-Founder Vitalik Buterin Sells Uniswap, KNC, Dogey-Inu In Latest Wallet Move

For updates and corrections, email newsroom[at]stocktwits[dot]com.<