Revenue rose 6.1% year-over-year (YoY) to a record high of $140.68 million during the quarter, beating a Wall Street estimate of $133.96 million. Adjusted earnings per share (EPS) came in at $0.59 versus an analyst estimate of $0.51.

Shares of IBEX soared over 11% on Friday after the company reported record quarterly revenue and topped Wall Street estimates on earnings.

Revenue rose 6.1% year-over-year (YoY) to a record high of $140.68 million during the quarter, beating a Wall Street estimate of $133.96 million. Adjusted earnings per share (EPS) came in at $0.59 versus an analyst estimate of $0.51.

Net income rose 52.6% YoY to $9.27 million, primarily led by the impact of revenue growth, particularly in higher margin offshore regions, improved gross margin performance, and fewer diluted shares outstanding compared to the prior-year quarter.

The firm raised its fiscal 2025 guidance and expects revenue to be in the range of $525 to $535 million versus a previous range of $515 to $525 million. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) are expected to be in the range of $68 to $69 million versus a previous range of $67 to $69 million.

CEO Bob Dechant said the second quarter saw the highest revenue growth for the firm in two years with revenues growing over 6%. “Our growth continues to be driven by winning new clients and increasing market share within our embedded base clients. These key wins resulted in 14% revenue growth in our most profitable offshore regions,” he said.

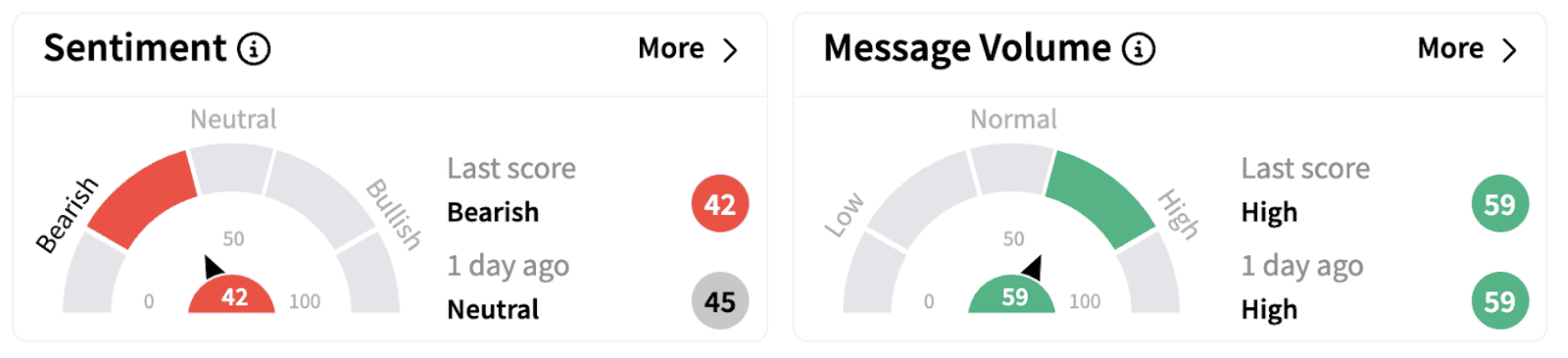

Despite the positive news, retail sentiment on Stocktwits dipped into the ‘neutral’ territory (42/100), accompanied by high retail chatter.

According to The Fly, RBC Capital analyst Daniel Perlin raised the firm's price target on the stock to $24 from $21 while keeping a ‘Sector Perform’ rating on the shares. Baird analyst David Konig raised the firm's price target on the shares to $28 from $26 while keeping an ‘Outperform’ rating.

IBEX shares have gained over 13% in 2025 and have risen over 42% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<