Data from DeFiLlama shows the total assets held in wallets linked to Bybit plummeted from $16.9 billion before the attack to $11.6 billion at the time of writing.

Ethereum (ETH) fell over 4% on Monday despite showing weekend resilience, as fallout from Bybit’s record $1.5 billion hack rippled through the market. The breach triggered a $4 billion “bank run,” bringing total outflows to $5.5 billion.

Bybit suffered a $1.5 billion exploit, triggering a broader crisis that led to a $4 billion “bank run,” bringing total outflows to $5.5 billion.

Data from DeFiLlama shows the total assets held in wallets linked to Bybit plummeted from $16.9 billion before the attack to $11.6 billion at the time of writing.

Ben Zhou said Sunday the exchange had replenished its Ethereum reserves, closing a $1.4 billion deficit and updated its audited proof-of-reserve in pre-market U.S. trading.

Blockchain security firm Elliptic warned that the stolen funds are likely being laundered through crypto mixers to obscure the transaction trail. The firm attributed the hack to North Korea’s Lazarus Group, which has a history of targeting crypto platforms.

“If previous laundering patterns are followed, we might expect to see the use of mixers next,” it said in its report.

Lazarus typically converts stolen tokens into ETH before using mixers to obfuscate transactions, forecast Elliptic.

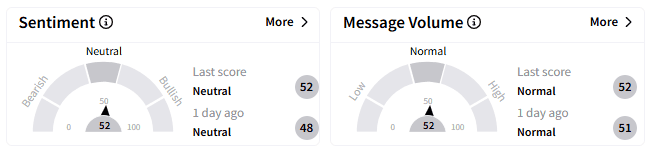

On Stocktwits, retail sentiment around Ethereum’s native token remained in ‘neutral’ territory.

While traders expressed frustration over the broader market downturn, many attributed Ethereum’s decline to Bitcoin’s price action rather than the Bybit hack.

In a post-hack live stream, Zhou revealed that hackers drained 70% of Bybit’s Ether holdings, forcing the exchange to secure emergency liquidity.

However, stablecoins – not ETH – saw the most significant withdrawals. A liquidity crisis emerged when custody provider Safe temporarily disabled smart wallets, locking $3 billion in USDT.

As withdrawals mounted, Bybit’s team manually verified signatures to recover reserves, but the crisis fueled a 50% drawdown of total assets.

Meanwhile, some industry figures, including BitMEX co-founder Arthur Hayes, suggested rolling back Ethereum’s blockchain to recover funds.

Zhou said Bybit consulted Vitalik Buterin and the Ethereum Foundation but received no definitive response.

While technically feasible, such an action would require overwhelming consensus among Ethereum stakeholders and could result in a hard fork, effectively splitting the network.

ETH is currently trading near the $2,687 level. Traders are likely to watch out for a move toward the $2,350 level, which has acted as a strong support since August 2024.

It remains down over 18% in the past month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Ethereum Falls As Bybit Gets Hit By The Biggest Crypto Hack in History – Retail Traders Fume