Mobile and EMS division led the earnings growth, with steady contributions from home appliances and consumer electronics divisions

Dixon Technologies shares rose over 2% on Wednesday after reporting strong quarterly earnings post-market hours on Tuesday. The company was among the top five trending stocks on Stocktwits.

The electronic components manufacturer reported a 100% jump in consolidated net profit to ₹280 crore for Q1FY26, while revenue also nearly doubled to ₹12,835 crore.

The strong performance was driven by its Mobile & Electronics Manufacturing Services (EMS) division, which accounted for 82% of operating profit and 91% of total revenue.

Sequentially, revenue grew 25%, while profit after tax (PAT) declined to ₹280 crore from ₹366 crore in Q4FY25 due to an exceptional gain in the previous quarter. Free cash flow turned positive at ₹57 crore.

Results Breakdown

While growth was primarily driven by the contributions from the Mobile & EMS segment, other segments, such as home appliances and consumer electronics, also made a steady impact. Operational efficiency improved, with working capital days slightly better and ROE and ROCE rising to 49.1% and 33.9%, respectively.

However, other income dropped to ₹2 crore, and margins compressed slightly. The Lighting segment underperformed, and ongoing capital expenditures continue to weigh on free cash flow.

Strategically, the company is focusing on expanding its Original Design Manufacturing (ODM) portfolio across the telecom, wearables, and IT hardware sectors. The management reaffirmed its commitment to value-added manufacturing in segments such as hearables and smart appliances.

Looking ahead, Dixon aims to improve margins by increasing automation to improve efficiencies across its EMS divisions. Its joint ventures with Q Tech India for camera modules and Yuhai Precision for enclosures are expected to support innovation while keeping capital expenditure in check.

Technical Analysis

Dixon Technologies stock has recently had a clean technical breakout, noted SEBI-registered analyst Rajneesh Sharma. The stock broke out of a 5-month symmetrical triangle pattern, confirming a bullish setup backed by rising volume.

Key support levels lie at ₹15,874, ₹13,706, and ₹12,210, while immediate resistance is seen at ₹17,096, Sharma said.

The relative strength index (RSI) stands at 57.25, which is well above its moving average and indicates no overbought signal. Volume trends remain healthy, with bullish candles showing stronger participation.

The overall bias remains bullish across all timeframes, including short, medium, and long-term.

Meanwhile, analyst Vishal Trehan identified support levels at ₹15,400–₹15,800 and resistance near ₹16,300.

Goldman Sachs retained its ‘Sell’ rating despite the strong Q1 performance but raised the target price to ₹11,110 from ₹10,030, citing operational ramp-up and value addition.

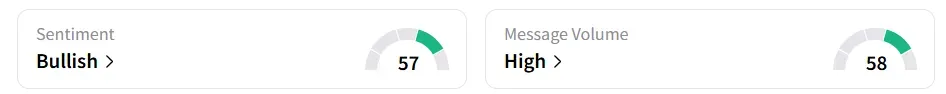

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes.

Year-to-date, the stock has shed 7.9%

For updates and corrections, email newsroom[at]stocktwits[dot]com<