Bitcoin spot ETFs recorded $560 million in net inflows on Monday, snapping a four-session outflow streak.

- Fidelity Wise Origin Bitcoin Fund led inflows, attracting $152.3 million.

- BlackRock’s iShares Bitcoin ETF followed with $142 million added to holdings.

- Ethereum spot ETFs continued to see outflows.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) opened February with $560 million in inflows on Monday, snapping a four-session stretch that saw more than $1.5 billion flow out of the funds.

Ethereum (ETH) spot ETFs continued to see outflows, though there was a notable decrease to $2.9 million on Monday, as compared to nearly $253 milllion on Friday last week.

Fidelity and BlackRock Lead Bitcoin ETF Inflows

According to data from Farside Investors, Fidelity Wise Origin Bitcoin Fund (FBTC) led inflows with $152.3 million flowing in. The ETF edged 0.16% higher in pre-market trading, with retail sentiment on Stocktwits shifting to ‘bullish’ from ‘bearish’ over the past day. Chatter remained at ‘high’ levels.

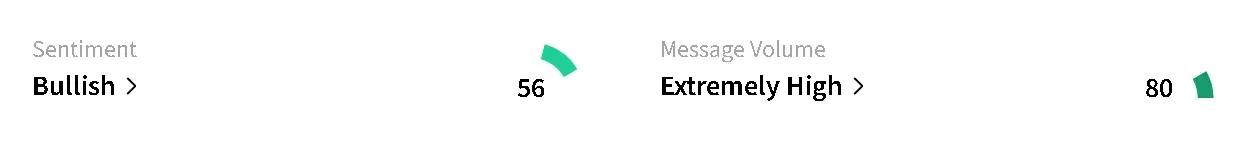

The iShares Bitcoin ETF (IBIT) followed with $142 million capital being added to its holdings. The fund moved 0.20% higher in pre-market trade. Retail sentiment around the ETF also flipped to ‘bullish’ from ‘bearish’ over the past day, with chatter rising to ‘extremely high’ from ‘high’ levels.

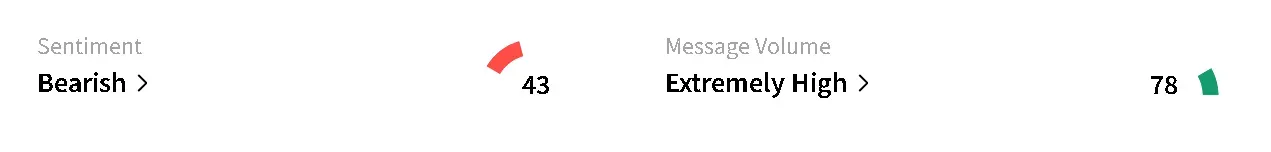

The ARK 21Shares Bitcoin ETF (ARKB) saw $65.1 million in inflows, coinciding with Ark Invest adding shares of the ETF to its ARK Fintech Innovation ETF (ARKF) and ARK Next Generation Internet ETF (ARKW). The ETF moved 0.19% higher in pre-market trade, but retail sentiment around the fund remained in ‘bearish’ territory over the past day, even as chatter rose to ‘extremely high’ from ‘high’ levels.

The Bitwise Bitcoin ETF (BITB) recorded $96.5 million in inflows. The Invesco Galaxy Bitcoin ETF (BTCO), VanEck Bitcoin Trust (HODL), WisdomTree Bitcoin Fund (BTCW), and Grayscale Bitcoin Trust (BTC) also posted inflows, but they were modest by comparison.

Crypto Markets Stabilize

Bitcoin’s price edged 0.7% higher in the last 24 hours to around $78,100 – paring gains after clocking an intra-day high of over $79,000. The apex cryptocurrency remains nearly 40% below its record high of over $126,000 seen in October last year.

On Stocktwits, retail sentiment around BTC improved to ‘bearish’ from ‘extremely bearish’ territory amid chatter at ‘extremely high’ levels.

Meanwhile, Ethereum’s price edged just 0.2% higher in the last 24 hours to around $2,270. Retail sentiment around the leading altcoin remained in ‘bearish’ territory over the past day, accompanied by ‘extremely high’ levels of chatter.

Read also: Cathie Wood Says ‘I Would Shift From Gold To Bitcoin’ As ARK Invest Buys The Dip In Crypto Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.<