The price of tea, idlis and other eatables have increased Many basic ingredients do not come under GST system including milk powder and rice Here are 45 items which do not come under GST or the rate has decreased

Various outlets including hotels in Bengaluru have increased the price of all the commodities they sell. Even the price of tea, idlis and other eatables have increased. But Why?

It is the GST effect, say hoteliers. But in fact, there are many basic ingredients which do not come under GST system including milk powder and rice.

Here we give you 10 important ingredients used for making tea, idlis, dosa and other favourite dishes of the Bengalureans which do not come under GST.

On tea, milk powder, sugar there is zero percent GST as these items do not come under the new tax system. Then, why should the price of tea go up? In another example, rice, unbranded flour, edible vegetable oil also does not come under the new tax system.

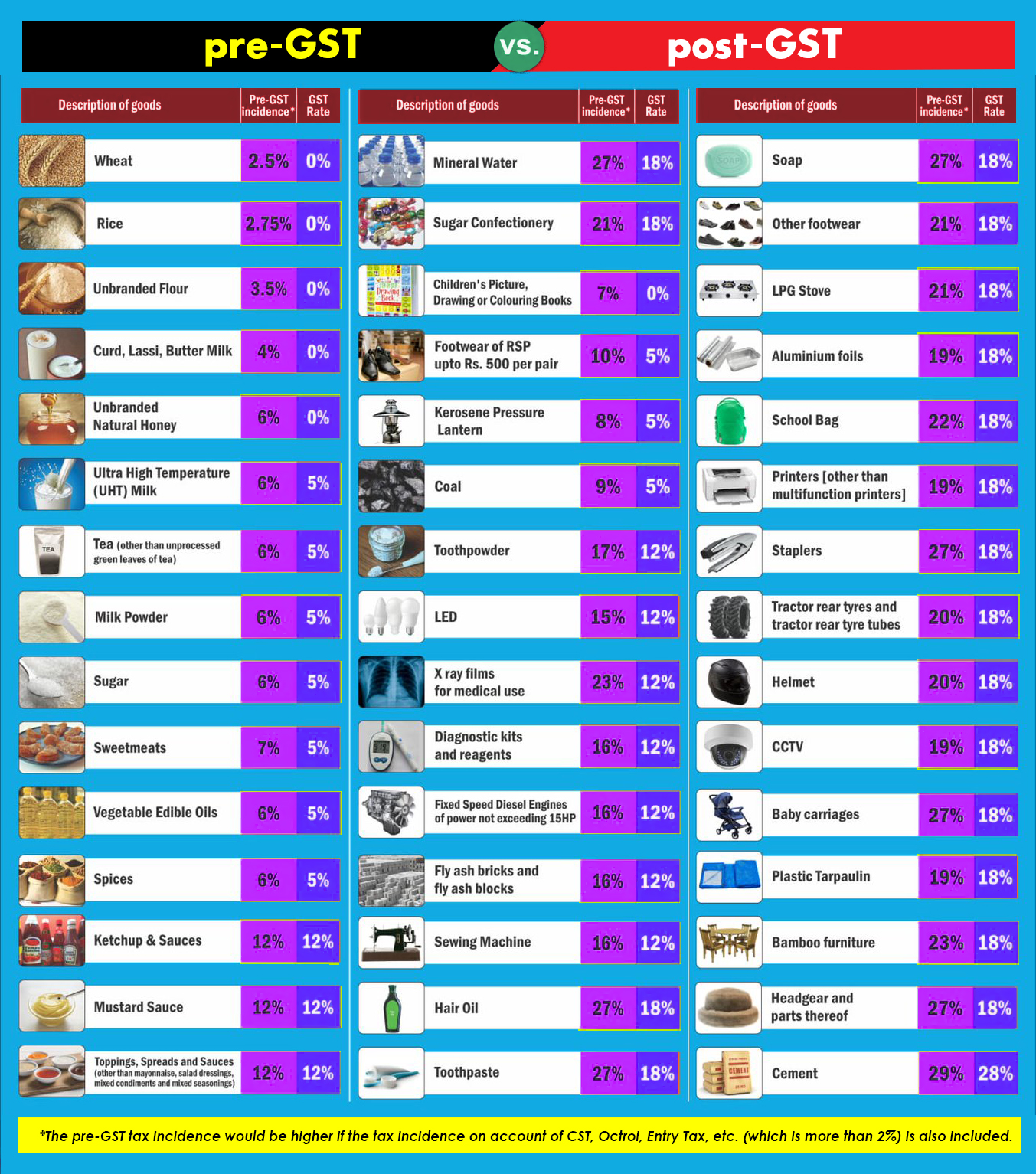

Here are 45 items which either do not come under GST or the rate has come down.

Goods and Services Tax applies in two ways to hotels. For those below Rs 75 lakh annual turnover the tax charged with be 5 per cent and 12 per cent of turnover above Rs 75 lakh. Most darshinis come under the second category, from the current composition tax of 4 per cent, most eating joints will now jump to the 12 per cent tax slab under GST.