They are strictly limited to authorized search operations conducted only when there is concrete proof of significant tax evasion. These measures, which are not new, are aimed at tackling black money, not invading the privacy of law-abiding citizens.

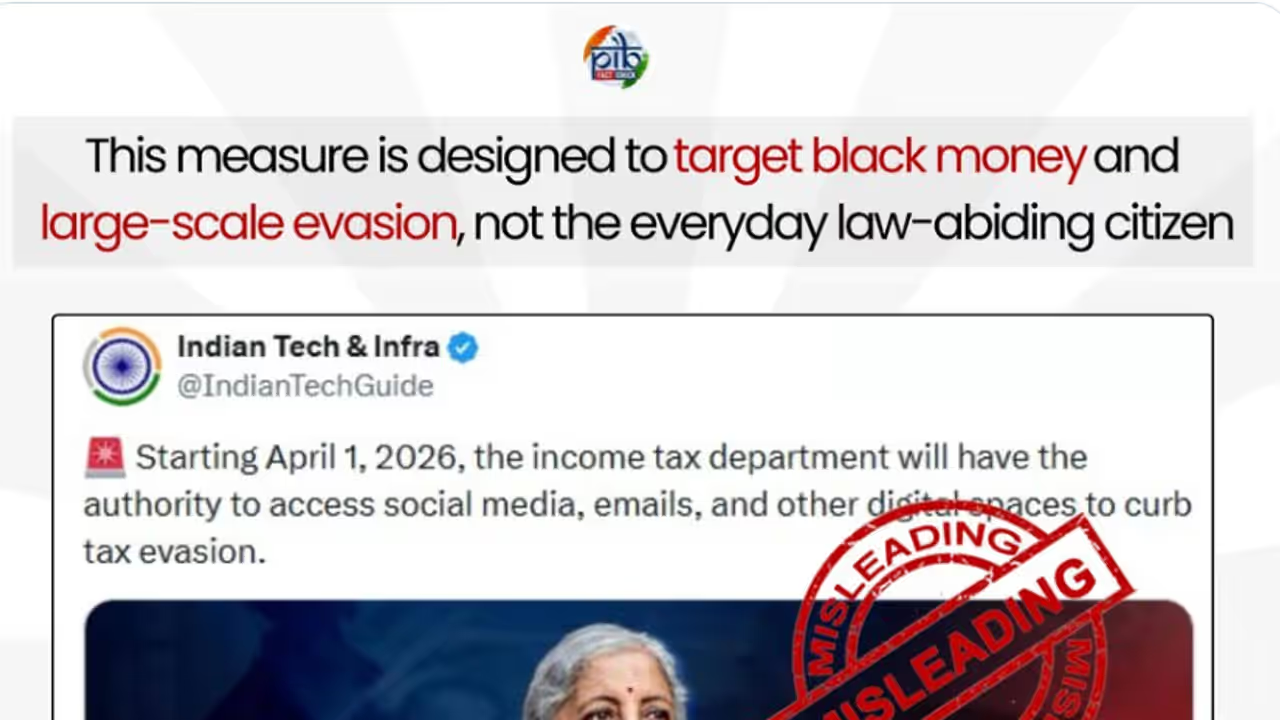

The Press Information Bureau’s Fact Check unit (PIB Fact Check) has debunked a viral social media claim suggesting that from April 1, 2026, the Income Tax Department will have sweeping powers to access citizens’ social media accounts, emails and other digital platforms to curb tax evasion.

The claim, shared by a social media account named @IndianTechGuide, was labelled misleading by PIB Fact Check, which issued a detailed clarification to address growing public concern. According to the government, the viral post misrepresents provisions under the Income Tax Act, 2025, particularly Section 247.

PIB Fact Check clarified that the provisions under Section 247 are strictly limited to Search and Survey operations conducted by the Income Tax Department. These powers come into play only when there is concrete evidence of significant tax evasion and a formal search operation has been authorised. Contrary to the viral claim, the department does not have blanket authority to monitor or access private digital communications of ordinary taxpayers.

The clarification further emphasised that these powers cannot be used for routine information gathering, regular processing of returns, or even in cases under scrutiny assessment. The measures are specifically aimed at tackling black money and large-scale tax evasion, not at invading the privacy of law-abiding citizens.

PIB Fact Check also noted that the power to seize documents and evidence during authorised search and survey operations is not new. Similar provisions have existed since the Income Tax Act of 1961, and the updated law does not introduce unrestricted digital surveillance.

The government urged citizens to avoid spreading unverified claims and to rely on official sources for accurate information, warning that misinformation around taxation laws can create unnecessary panic. PIB Fact Check reiterated its role in countering false narratives and ensuring clarity on government policies.