The report reveals that Pakistan's per capita debt has increased by 36% from $823 in 2011 to $1,122 in 2023, while GDP per capita has seen a 6% decline during the same period.

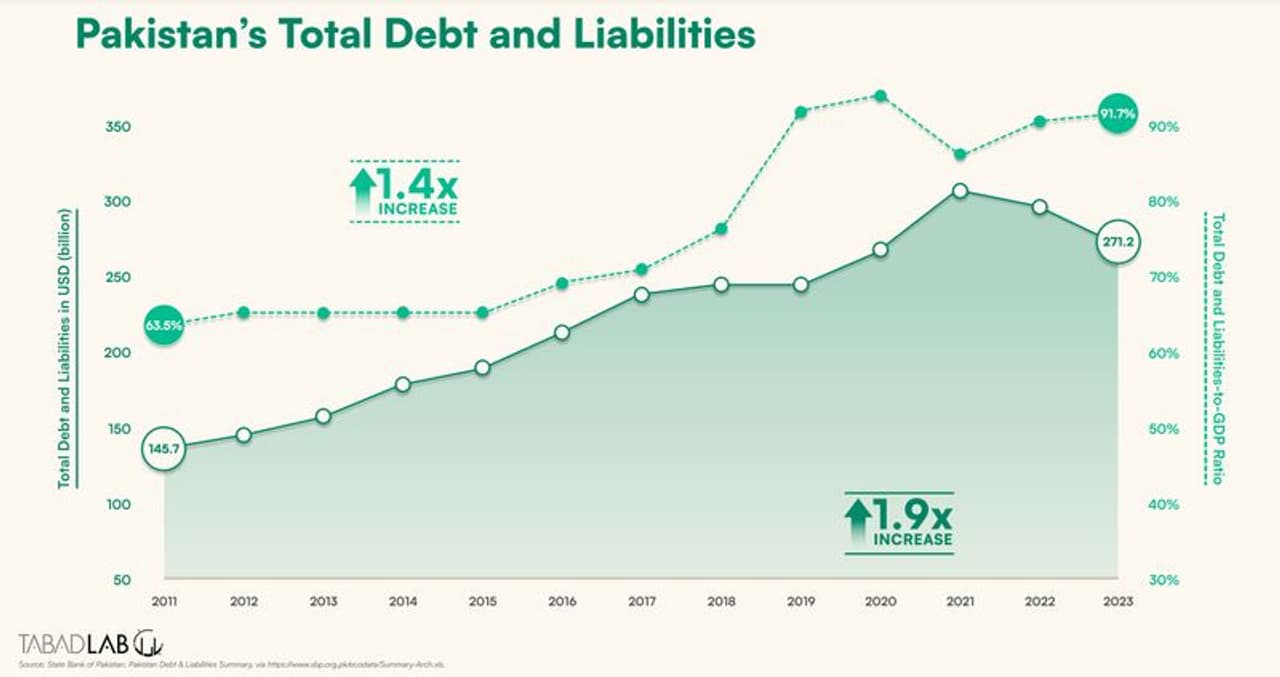

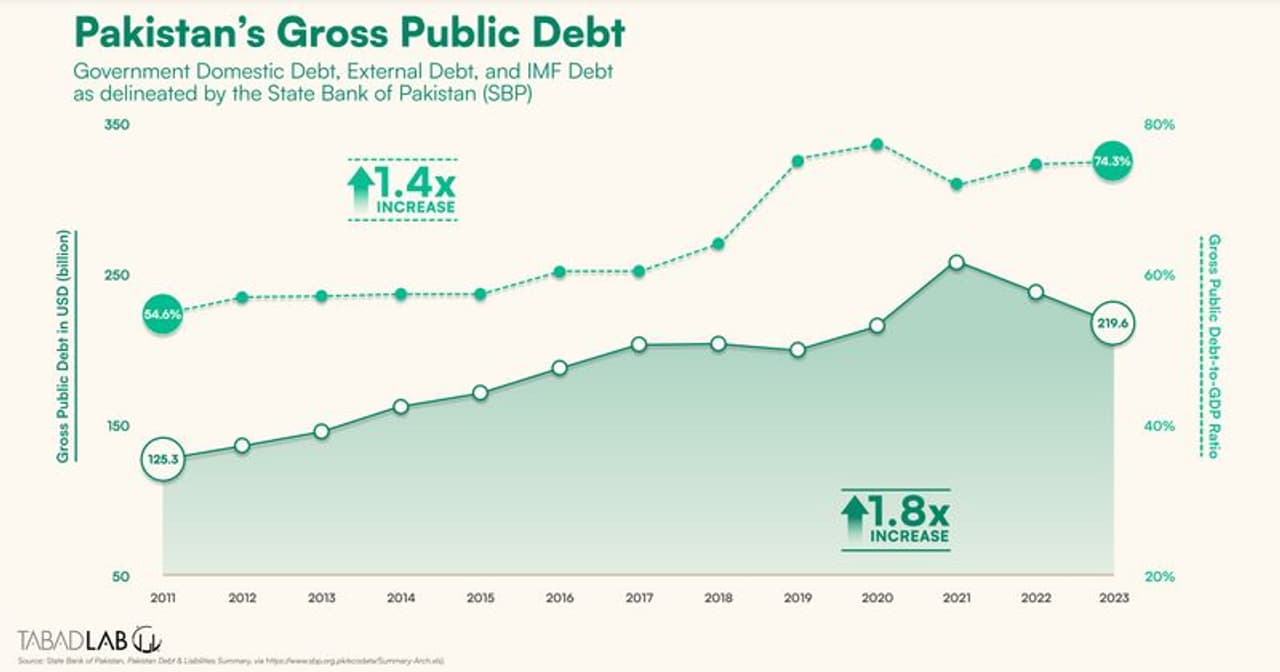

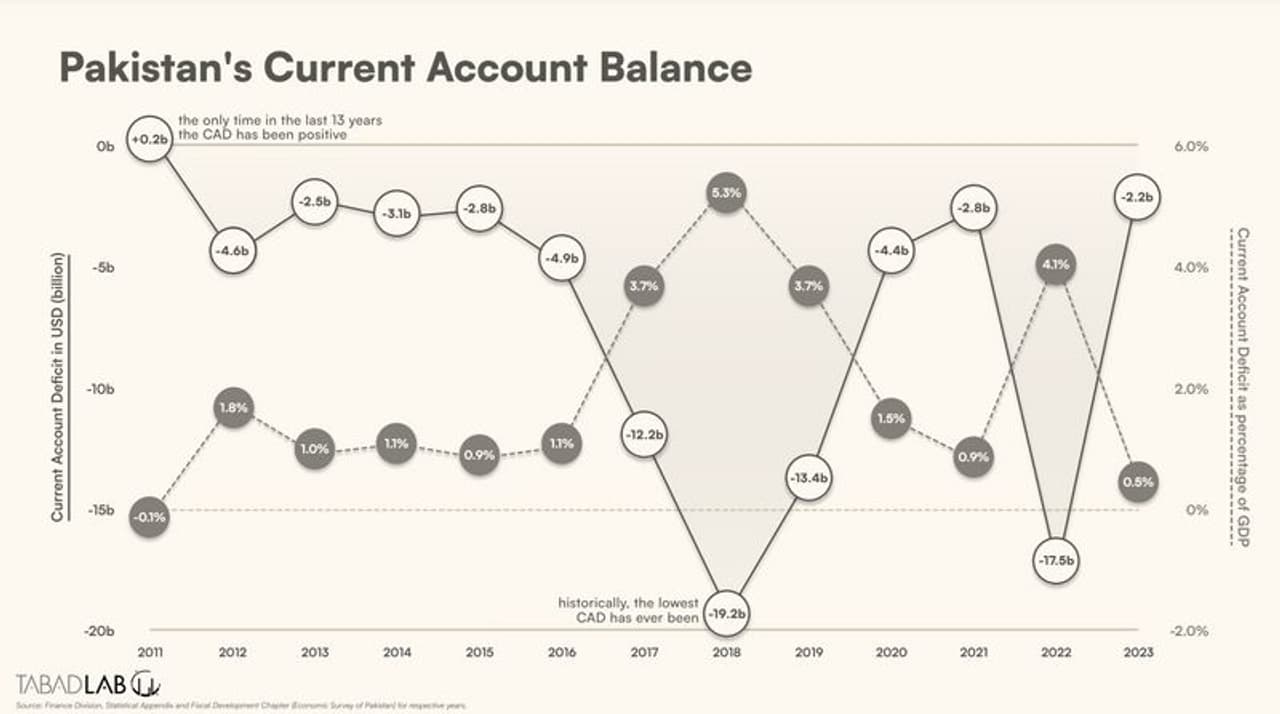

Pakistan is currently grappling with a severe financial crisis, as highlighted in a report by the Islamabad-based think tank, Tabadlab. The report paints a grim picture of the country's financial health, describing its debt situation as a "raging fire" and far more critical than the International Monetary Fund's (IMF) assessment of being "borderline" manageable. With debt levels reaching alarming highs, Pakistan faces the prospect of an "inevitable default," which could trigger a devastating economic spiral.

Also read: At $365 billion, Tata Group's market value is now more than entire economy of Pakistan

The report reveals that Pakistan's per capita debt has increased by 36% from $823 in 2011 to $1,122 in 2023, while GDP per capita has seen a 6% decline during the same period. This widening gap between debt and income growth indicates a need for additional borrowing, contributing to the country's precarious financial situation.

The uncertainty surrounding Pakistan's debt sustainability has already negatively affected the stock market. Prime ministerial hopeful Shehbaz Sharif has emphasized the urgent need for a new IMF bailout to avert a crisis. The looming debt crisis has wider implications, affecting economic sentiment among voters and adding a layer of complexity to an already contentious election.

The report outlines that since 2011, Pakistan's external debt has nearly doubled, while domestic debt has increased sixfold. For FY-2024, the country faces an estimated debt maturity of USD 49.5 billion, with interest payments accounting for 30%, excluding bilateral or IMF loans. The majority of the accumulated debt has supported a consumption-driven and import-heavy economy, lacking investment in productive sectors or industries.

The growing population in Pakistan intensifies the need for increased funding in social protection, health, education, and climate change adaptation. The report underscores the intertwined challenges of climate vulnerability and debt, presenting an opportunity for simultaneous mitigation and synergy. Interest payments on the debt now consume a record share of the GDP, highlighting the severity of the debt burden.

Tabadlab's report suggests innovative solutions like debt-for-nature swaps to alleviate the debt crisis while addressing environmental conservation needs. Given Pakistan's susceptibility to climate disasters, substantial financial resources are required for recovery and adaptation, making the intersection of debt and climate change a critical area for intervention.

The report concludes that without transformative change and comprehensive reforms, Pakistan's debt crisis will only worsen. It emphasizes the need for sweeping reforms and dramatic changes to the status quo to avert an inevitable default. As the country stands on the brink of a full-blown economic disaster, strategic interventions are imperative to navigate through these challenging times and put Pakistan back on the path to economic stability.