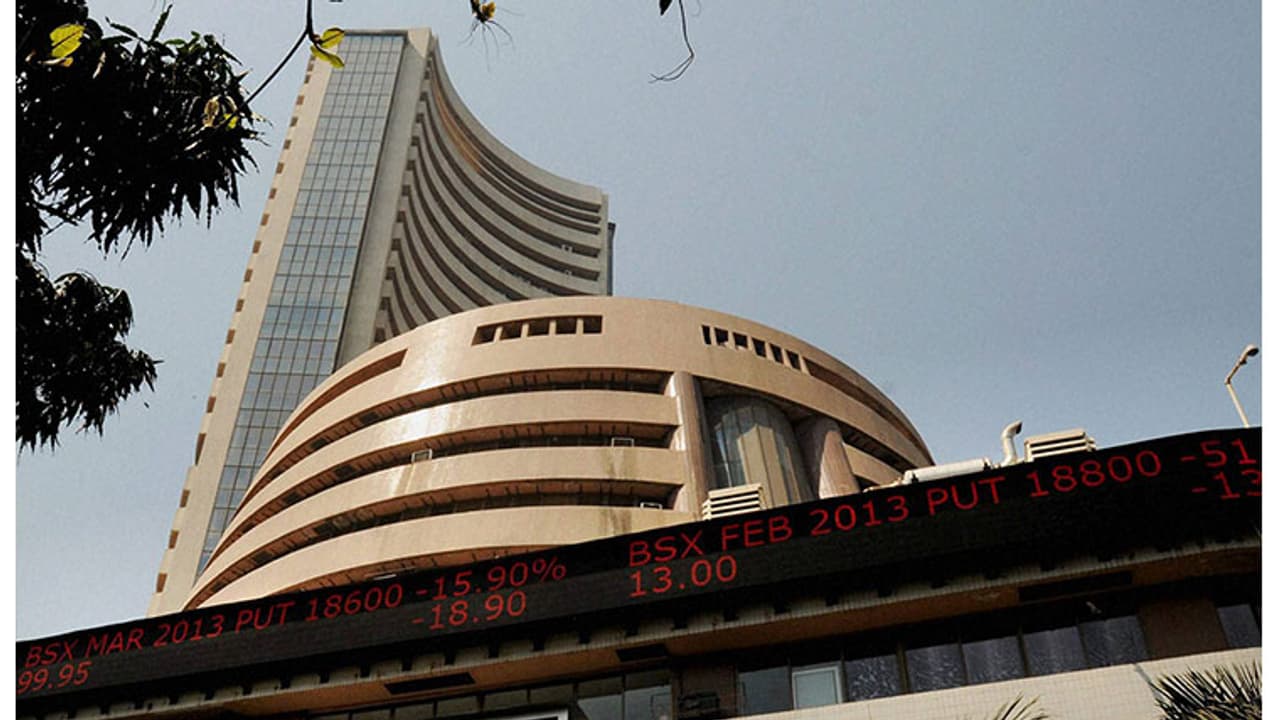

The benchmark BSE Sensex could dive to 22,000 levels by the end of the current fiscal, owing to adverse global developments following Britain's exit from the European Union, says a report.

According to financial services firm Ambit Capital, while the direct effects of Brexit on India appear "worrisome but manageable, it is the second round impacts that could affect India more profoundly."

These include China seizing Brexit as an opportunity to devalue decisively its currency and Europe facing a recession.

Accordingly, the report said, "fair value for the Sensex is 29,500 for fiscal ending March 2017, we reiterate that there is a high risk of the index sliding to 22,000 in the wake of adverse global developments".

The report noted that the increase in global uncertainty owing to Brexit alongside Raghuram Rajan's departure from the RBI could trigger a flight of FII debt from India, which in turn is likely to push up the short-term commercial paper and commercial deposit rates.

On global developments, Ambit observed that as Brexit is likely to create sustained demand for US dollars as investors seek a haven in an uncertain world.

"This appreciation in the US dollar gives China a golden opportunity to seize the opportunity thrown up by Brexit to decisively devalue its currency and thus boost its flagging GDP growth," the report said.

Noting that Europe is already dealing with negative CPI inflation and negative interest rates, Ambit said it will now have to contend with the prospect of a drop in business confidence, which could tip EU into recession and thus destroy its enfeebled banks.

Moreover, Ambit said the UK having voted to exit the EU would also trigger direct adverse changes for India such as its exports and a slowdown in FDI and FII flows into the country owing to low confidence among global businesses.

These would also put pressure on the rupee as well as pressure on domestic money market liquidity.

"Since any regions import demand is driven by its GDP growth, Indias exports to the UK, as well as EU, are likely to be adversely impacted as EU accounts for 17 per cent of Indias exports with the UK having a share of 3 per cent," Ambit said.

"Britain's exit from the EU is likely to lower business and investor confidence levels around the world which will adversely impact FDI as well as FII flows into India," it added.