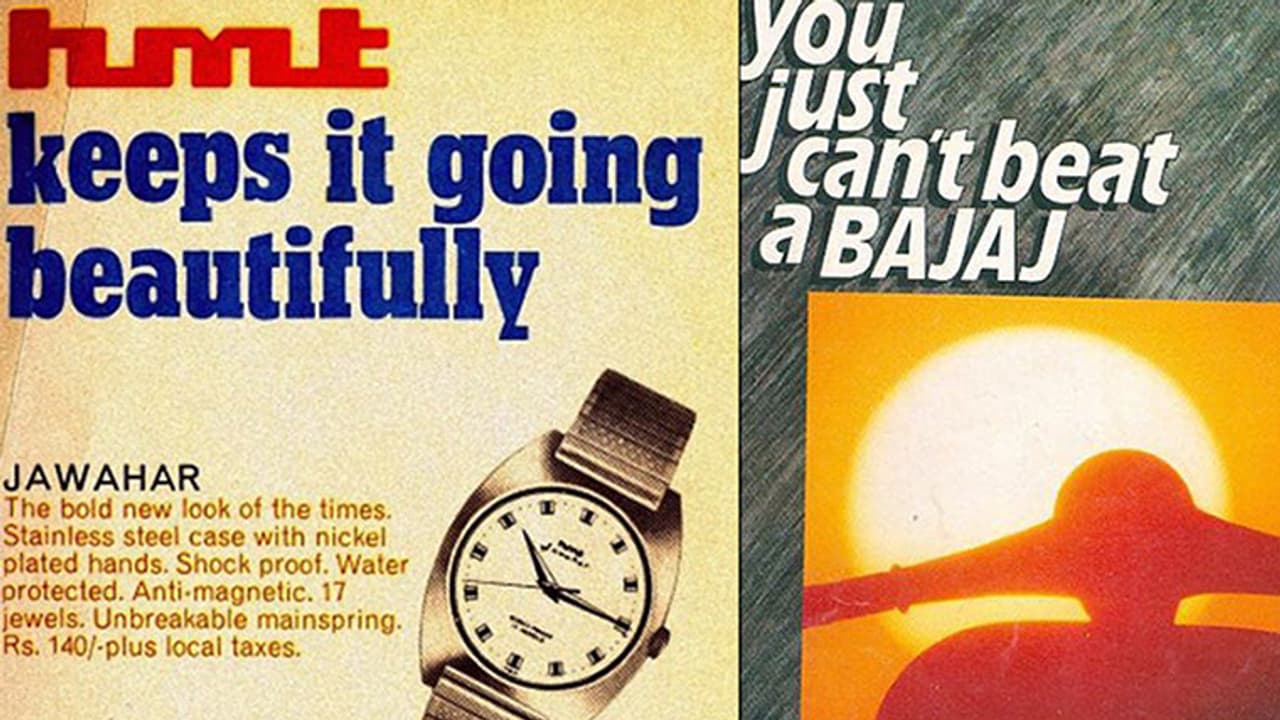

In 1991, when India was forced to liberalise its socialist economy, everything changed for its vast, teeming middle-class populace that was used to HMT watches, Bajaj scooters and Ambassador or Fiat cars.

This populace would patiently stand in line for gas connections, book long distance STD calls and buy overpriced Indian Airlines tickets if there was an emergency or else happily travel in 3-tier trains across the country.

It would also watch Chitrahar, He-Man and Spiderman cartoons along with iconic television serials like Nukkad, Hum Log, Buniyaad and Yeh Joh Hain Zindagi on the one and only Doordarshan channel, broadcasted intermittently on prized black and white television sets along with a posse of relatives and neighbours.

The young in this populace mostly got jobs in the public sector with large government-owned companies, or joined the bureaucracy, or became teachers or professors or at best joined the defence forces. The private sector was largely disorganised or dominated by a handful of Tatas, Birla's and Ambani's.

Here are some of the more 'personal' fruits of liberalisation that we now take for granted, but were unthinkable back then:

Private banks, ATMs, debit and credit cards, wealth and portfolio managers, satellite television, multiplex cinemas, private airlines and airports, modern retail shopping experiences, easy to access telecom services, investment banks, venture capitalists, angel investors and Indian start-ups. And of course - Coca-cola.

All of this began to change in 1991 when near bankruptcy made the government undertake a systemic shift to a more open economy with greater reliance upon market forces, a larger role for the private sector (including foreign investment) and a restructuring of the role of the government.

These reforms helped free the domestic economy from the old, highly controlled economic regime. Key pillars of that previous regime were systematically dismantled. Key ones being the dominance of the public sector in industrial activity, discretionary controls on industrial investment and capacity expansion, trade and exchange controls, limited access to foreign investment, and public ownership and strict regulation of the financial sector.

Most of the central government industrial controls were dismantled, and a massive deregulation of the industrial sector was done to bring in an element of competition and increase efficiency. Industrial licensing by the central government was almost abolished except for a few hazardous and environmentally sensitive industries. The list of industries reserved solely for the public sector - which used to cover 18 industries was drastically reduced to three: defence aircraft and warships, atomic energy generation, and railway transport.

Further, restrictions that existed on the import of foreign technology were also withdrawn.

The country's overall trade policy was also completely overhauled as it was realised that the import-substituting, inward-looking development policy was no longer feasible in a modern, globalising world. Before the reforms, trade policy was characterised by high tariffs and pervasive import restrictions. The criteria for issue of licenses were non-transparent, delays were endemic and corruption a standard way of life.

Quantitative restrictions on imports of manufactured consumer goods and agricultural products were finally removed on April 1, 2001, almost exactly ten years after the reforms began, and that in part because of a ruling by a World Trade Organization dispute panel on a complaint brought by the United States.

Financial sector reforms were also undertaken, where the Indian financial system was incrementally deregulated and exposed to international financial markets along with the introduction of new instruments and products.

Following is a list of all the fruits of liberalisation that simply did not exist before liberalisation:

The 'private' sector

The Indian corporate sector emerged across sectors after liberalisation. Many companies began their journey across manufacturing and services sector, slowly becoming a mainstay of Indian life.

Jobs and money

Tremendous employment opportunities were created across the private sector, and purchasing power, per capita income and overall consumer spending, grew enormously across the middle-class.

Exports grew exponentially

From $ 17.9 billion in 1991-92, the value of exports has increased to more than $ 300.6 billion now.

Stock-markets

Indian punters took to the bourses in hoards and learnt the sweet guilty pleasure of gambling and risking it all. In the process, they built the financial futures of many iconic companies like Reliance Industries, Infosys, Wipro, etc.

Global trade

The international trade to GDP ratio, which was just 15% in 1991-92 is now 44%, and it is a number that we are still looking to drive higher.