Investors are assessing potential legal exposure and compliance costs tied to the case.

- The state alleged negligence and tied the fire to aging utility equipment.

- Damage was extensive, with major losses to land, livestock and communities.

- Analysts trimmed targets earlier, while keeping ratings mostly intact.

Xcel Energy shares slid on Tuesday, putting the stock on track to hit its lowest levels in nearly three months, after Texas filed a lawsuit accusing the utilities company of causing the largest wildfire in the state’s history.

The stock declined 2% at the time of writing.

Texas Files Lawsuit Over Smokehouse Creek Fire

Texas Attorney General Ken Paxton said he has filed a lawsuit against Southwestern Public Service Company, which operates in Texas as Xcel Energy, over the 2024 Smokehouse Creek Fire in the Texas Panhandle. The fire, described as the largest wildfire ever recorded in Texas, killed three people, according to the suit.

Paxton said the blaze was sparked by Xcel’s utility equipment and could have been avoided, accusing the company of failing to fix aging infrastructure despite known wildfire risks.

Allegations Of Negligence And Infrastructure Failures

The attorney general’s office said Xcel previously admitted one of its utility poles caused the fire in public statements. The lawsuit alleges the company failed to replace aging poles, some nearly a century old, far beyond their expected 40-year lifespan.

The Smokehouse Creek Fire burned over a million acres, killed more than 15,000 head of cattle and caused billions of dollars in damage to farmland and wildlife. State officials say the disaster's total economic impact topped $1 billion.

Legal Stakes

Paxton said his office opened an investigation into the fire in August. The lawsuit aims to recover the state’s losses, including property damage and harm to wildlife and habitat, along with civil penalties tied to alleged violations of Texas law.

Texas is also asking the court to order Xcel to make changes to its operations and infrastructure to help ensure a similar disaster does not happen again.

Recent Analyst Revisions

Analyst sentiment has also softened modestly this month. Morgan Stanley lowered its price target on Xcel Energy to $79 from $84 while keeping an ‘Equal Weight’ rating, saying utility performance will be heavily influenced by data center demand and growth opportunities into 2026.

KeyBanc trimmed its target to $84 from $85 but maintained an ‘Overweight’ rating, noting the stock is trading at a rare discount to large-cap peers despite Xcel’s track record of execution, leadership in renewables and long-term rate base growth. However, KeyBanc called the stock among “the strongest equity compounder stories in the sector.”

JPMorgan also cut its price target to $87 from $90 while reiterating an ‘Overweight’ rating, reflecting updated assumptions across the North American utilities sector.

How Did Stocktwits Users React?

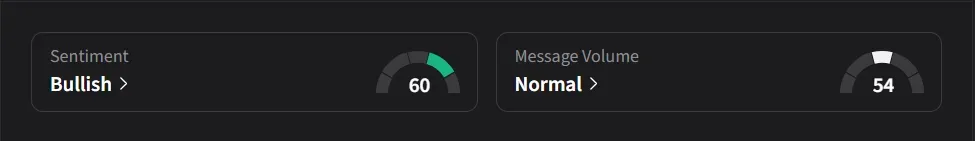

On Stocktwits, retail sentiment for Xcel was ‘bullish’ amid ‘normal’ message volume.

Xcel Energy’s stock has risen 14% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<