According to a CNBC report, analysts led by Vivek Arya emphasize that the AI trade is still in its early to mid stages, with strong growth potential despite some market fluctuations.

- Analyst Vivek Arya said that chipmakers tied to AI applications are expected to keep generating solid returns.

- Arya forecasts a 50% year-over-year growth for AI semiconductors in 2026, driven by heavy data center usage, and supply constraints.

- Semiconductor sales are expected to climb roughly 30% in 2026.

Bank of America has reportedly taken a positive stance on artificial intelligence investments for 2026, highlighting continued opportunities in semiconductor and AI-related stocks.

According to a CNBC report, analysts led by Vivek Arya emphasize that the AI trade is still in its early to mid stages, with strong growth potential despite some market fluctuations.

AI Sector Outlook

Arya said that chipmakers tied to AI applications are expected to keep generating solid returns, although price movements may be volatile. The analysts suggest that the market may still undervalue the essential role of AI-focused semiconductor companies in powering large-scale computing and enterprise solutions.

According to the report, Arya forecasts a 50% year-over-year growth for AI semiconductors in 2026, driven by heavy data center usage, supply constraints, widespread enterprise adoption, and competition among large language model (LLM) developers.

Semiconductor sales are expected to climb roughly 30% next year, potentially pushing the industry’s revenue close to $1 trillion for the first time, according to the report.

Top Stock Picks

Bank of America highlighted six large-cap stocks as top AI investments, emphasizing companies with market leadership and strong fundamentals. The list includes Nvidia Corp (NVDA), Broadcom Inc. (AVGO), Lam Research Corp. (LRCX), KLA Corp. (KLAC), Analog Devices Inc. (ADI), and Cadence Design Systems Inc. (CDNS).

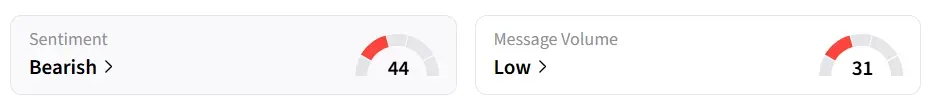

Nvidia’s stock inched 0.01% lower on Tuesday afternoon. On Stocktwits, retail sentiment around the stock changed to ‘bearish’ from ‘neutral’ territory the previous day amid ‘low’ message volumes.

Nvidia, up 32% this year, is the firm’s top pick due to its leadership in AI compute, while Broadcom benefits from strong profitability and free cash flow generation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<