Coupang remains under pressure as a massive data breach drives regulatory scrutiny, leadership changes and heightened risk concerns from analysts.

- Data exposure expanded to tens of millions of users after months of undetected access.

- Scrutiny intensified, with police raids, government probes and political pressure.

- Morgan Stanley flagged higher risk, cutting price targets despite stable core operations.

Coupang (CPNG) shares extended their losing streak to a sixth straight session on Tuesday, sliding toward their lowest levels in more than eight months as fallout from South Korea’s largest-ever data breach continued to weigh on investor sentiment.

Millions Of Accounts Affected

Coupang said it detected unauthorized access to customer data on Nov. 18 and reported it to authorities, initially estimating about 4,500 affected accounts. Further review later showed that the incident, now described as South Korea’s largest-ever data breach, may have exposed personal information tied to as many as 33.7 million customers, including names, phone numbers, email addresses, shipping details and some order history.

The company said no credit card data or login credentials were leaked. Coupang said the breach may have begun as early as June and involved an overseas server, affecting more than half of South Korea’s population.

Political Pressure Mounts

The breach drew regulatory and law enforcement scrutiny. South Korea’s internet authority and the Ministry of Science and ICT launched investigations into possible data protection violations, while police conducted multiple raids on Coupang’s headquarters.

Authorities said the breach unfolded over about five months, with systems repeatedly bypassed. President Lee Jae Myung criticized the failure to detect the intrusion, while media reports have linked a former Coupang employee, a Chinese national who worked on authentication systems, to the case. Coupang has not confirmed the suspect’s identity, according to a Bloomberg report.

CEO Resigns Amid Fallout

Park Dae-jun stepped down as CEO of Coupang’s Korean operations last week, claiming responsibility for the breach. The company named Harold Rogers, chief administrative officer and general counsel of its U.S.-based parent, as interim head, tasked with stabilizing the business and addressing customer concerns. Park had been named sole CEO less than seven months earlier.

Lawmakers have said Coupang could face fines of up to 1 trillion won ($681 million), with the government warning of strict sanctions if violations are found. The case has renewed debate over cybersecurity standards among major South Korean companies.

Morgan Stanley Cuts Price Target

Adding to the pressure on the stock, Morgan Stanley lowered its price target on Coupang to $31 from $35, while maintaining an ‘Overweight’ rating.

Analyst Seyon Park said the firm reduced estimates to reflect “heightened risk” following the personal information breach and embedded higher cybersecurity spending into its forecasts. Morgan Stanley, however, said it expects minimal disruption to Coupang’s core operations despite the incident.

How Did Stocktwits Users React?

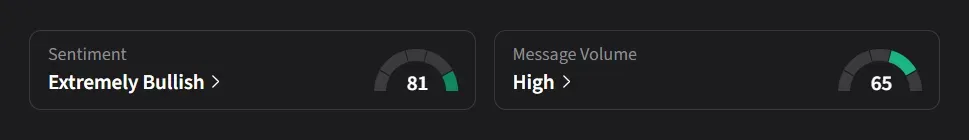

On Stocktwits, retail sentiment for Coupang was ‘extremely bullish’ amid ‘high’ message volume.

One user called the move an “orchestrated sell off with an appropriate narrative to grab some liquidity.”

Another user said a “massive reversal incoming.”

Coupang’s stock has risen 4.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<