The U.S. military has reportedly deployed a vast array of forces in the Middle East, comprising fighter jets, refueling tankers, and two aircraft carriers.

- According to a Bloomberg report, President Trump told reporters aboard Air Force One on Thursday that 10 to 15 days was “pretty much” the maximum amount of time he would give for negotiations for a nuclear deal with Iran.

- Despite the burgeoning U.S. military buildup in the Middle East, bettors on Polymarket think that the odds of a strike on Iran over the next month are 50:50 at most.

- During an address at a Board of Peace event on Thursday, President Trump said that the next 10 days will show whether the U.S.-Iran tussle escalates or a deal is struck.

Prediction markets are buzzing with activity over the prospect of a U.S. strike on Iran after President Donald Trump gave the Middle Eastern country 10 to 15 days to strike a nuclear deal.

According to a Bloomberg report, President Trump told reporters aboard Air Force One on Thursday that 10 to 15 days was “pretty much” the maximum amount of time he would give for negotiations for a nuclear deal with Iran.

“We’re either going to get a deal, or it’s going to be unfortunate for them,” he added.

Amid this, the U.S. military has deployed a vast array of forces in the Middle East, comprising fighter jets, refueling tankers, and two aircraft carriers, according to the report.

What Are Prediction Markets Indicating?

Despite the burgeoning U.S. military buildup in the Middle East, bettors on Polymarket think that the odds of a strike on Iran over the next month are 50:50 at most.

At the time of writing, the odds of a strike on Iran between February 20 and March 7 were in the range of 2% to 42%. March 15 is the first time these odds reach 50%. Thereafter, the odds continue to climb, reaching 76% by the end of the year.

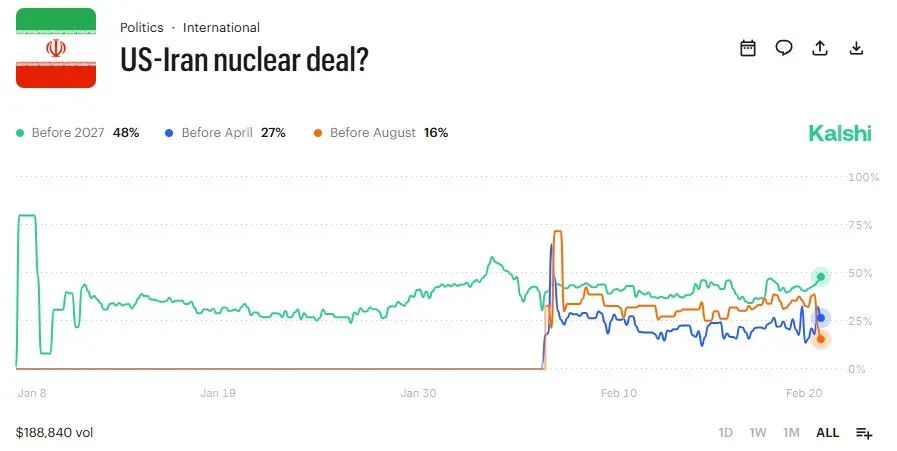

Bettors on Kalshi are pessimistic about the U.S. and Iran striking a nuclear deal, which would avert a strike.

The odds of a deal being struck before April plummeted 39 percentage points over the past 24 hours, falling to 27%. The chances of a deal before August 2026 are even lower, at just 16%. Bettors are slightly more optimistic that the deal will be reached before 2027, at 48%.

The total betting volumes on Polymarket regarding a U.S. strike on Iran stood at a staggering $323 million, while Kalshi users placed bets worth $189,000 about the odds of a nuclear deal.

Trump’s Warning To Iran

During an address at a Board of Peace event on Thursday, President Trump said that the next 10 days will show whether the U.S.-Iran tussle escalates or a deal is struck.

“Now we may have to take it a step further, or we may not. Maybe we're going to make a deal. You're going to be finding out over the next probably 10 days,” he said.

Rafael Mariano Grossi, Director General of the International Atomic Energy Agency, also warned on Thursday that the window for Iran to strike a nuclear deal is at risk of closing.

“There is not much time, but we are working on something concrete. There are a couple of solutions the IAEA has proposed,” Grossi said.

Meanwhile, U.S. equities were mixed in Friday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, edged lower by 0.01%, the Invesco QQQ Trust ETF (QQQ) rose 0.03%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.07%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was up by 0.17% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) rose 0.02%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<