Roku delivered strong fourth-quarter results and an upbeat outlook, thrusting the once-forgotten stock back into the spotlight.

- Roku posts net profit for the third straight quarter, turning the bottom line positive for 2025 after three years of losses.

- Streaming and devices company reports Q4 revenue, and sales expectations for Q1 and 2026 above Wall Street’s targets.

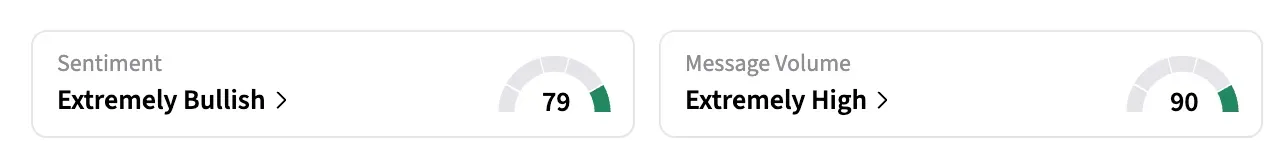

- Stocktwits sentiment shifts to ‘extremely bullish’ from ‘bullish’ for the stock.

Roku Inc. shares rose 13.6% in early premarket trading on Friday after the streaming company reported a return to net profitability, along with stronger-than-expected quarterly results and an upbeat outlook.

Against the backdrop of a sharp slide, Roku’s latest financial performance lifted sentiment, with retail traders saying the company appears to have reset its base and is poised for a stronger rebound.

Retail Sentiment Flips ‘Extremely Bullish’

Stocktwits sentiment shifted to ‘extremely bullish’ as of early Friday, from ‘bullish’ the previous day.

“Hate to be that person, but longs actually look great,” said one user. “Sitting right on top of a demand zone, long bottom wick showing buyer interest, rejected August lows, (and) RSI is at 27.29.”

Profitability Streak Extends

The video advertising and streaming company reported December quarter revenue of $1.39 billion, beating estimates of $1.35 billion, and net profit of $80.5 million. On an adjusted basis, per share earnings of $0.24 came in shy of expectations of $0.28.

Platform revenue grew 18% to $1.22 billion, while devices revenue ticked up 3% to $170.9 million.

2026 Revenue Outlook Tops Expectations

Roku’s first-quarter revenue outlook of $1.20 billion and 2026 revenue view of $5.50 billion also surpassed expectations of $1.16 billion and $5.34 billion, respectively.

Analysts See Operating Efficiency Gains

“We think the positive shift to net profit from prior losses and strategic focus on enhancing the Roku Experience has yielded strong results, as The Roku Channel became the #2 most engaged app on the platform in the U.S.,” CFRA Research analysts said in an investor note. The 2026 guide points to enhanced operating efficiency, they said.

Roku shares slid sharply over the recent weeks. They are down about 28% as of the last close.

Currently, 22 of 29 analysts recommend ‘Buy’ or higher on the stock, and seven recommend ‘Hold,’ according to Koyfin. Their average price target of $123.08 implies a 48% upside to the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<