While full-year 2026 revenue guidance came in below consensus, EPS guidance for both Q1 and the full year topped expectations.

- Corsair beat estimates on both earnings and revenue in Q4 as memory pricing and inventory dynamics lifted margins to record levels.

- The company is leaning into higher-margin categories like gaming peripherals, sim racing, and creator products.

- The company expects adjusted EBITDA to grow in 2026 despite lower revenue, supported by margin expansion and tighter cost control.

Shares of Corsair Gaming, Inc. (CRSR) slipped nearly 1% in premarket trading on Tuesday after the stock’s strongest single-session on record, as investors locked in gains following a wave of analyst updates tied to the company’s fourth-quarter (Q4) earnings and outlook.

CRSR stock posted its strongest single-day performance ever on Friday, surging nearly 50%.

Wall Street Analysts Trim Targets But See Upside

Baird lowered the firm’s price target to $6 from $7, implying a 12% downside from the stock’s last close, and reiterated a ‘Neutral’ rating. The brokerage said it updated its model following solid fourth-quarter results and noted a platform pivot underway.

Craig-Hallum cut its price target to $8 from $10, implying an 18% upside from current levels, while maintaining a ‘Buy’ rating. The firm highlighted the positive impact of industry-wide memory price increases, which allowed Corsair to sell lower-cost inventory at higher market prices, contributing to record gross margins in the quarter.

Barclays also lowered its price target to $8 from $9, implying roughly 18% upside from the prior close, and maintained an ‘Overweight’ rating.

Meanwhile, B. Riley raised CRSR’s price target to $7 from $6, implying a 3% upside from the stock’s last close, and kept a ‘Neutral’ rating. The firm said that the newly authorized $50 million share buyback and strong quarterly execution offset a cautious initial 2026 revenue outlook.

Record Margins Drive CRSR Q4 Earnings Beat

Corsair reported Q4 adjusted earnings per share (EPS) of $0.43, well above the $0.27 consensus estimate, on revenue of $436.9 million, which also topped expectations. For 2026, the company guided to revenue of $1.33 billion to $1.47 billion, below the $1.58 billion consensus, while forecasting adjusted EPS of $0.58 to $0.74, compared with a $0.65 consensus.

For the first quarter of 2026, Corsair expects adjusted EPS of $0.18 to $0.22, above the $0.14 consensus, on revenue of $335 million to $365 million, below the $389.9 million estimate.

Corsair Bets On Higher-Margin Expansion

On the earnings call, CEO Thi La said Corsair closed 2025 with “strong execution” and delivered its highest full-year gross margin as a public company.

The company said it will shift toward higher-margin categories such as gaming peripherals, sim racing, and creator products, alongside platform-based offerings like Stream Deck. CFO Gordon Mattingly said the company expects adjusted EBITDA to grow in 2026 despite lower revenue, driven by margin expansion, disciplined operating expense management, and mix improvement.

Corsair also announced its first-ever share repurchase authorization of up to $50 million, which Mattingly described as an attractive use of capital alongside continued investment in organic growth and selective mergers and acquisitions.

How Did Stocktwits Users React?

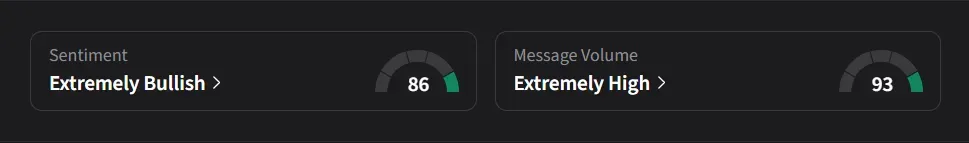

On Stocktwits, retail sentiment for CRSR was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “I shorted this last week, but it could break out big time for a huge move up,“ noting it is a “popular” memory brand for retail consumers and is one of the main brands sold to consumers through retail channels like Best Buy and Amazon.

Another user said, “No reason this should not be trading at least $8.”

CRSR stock has declined 46% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<