The company announced that the FDA called for an additional Phase 3 trial of its schizophrenia treatment drug.

- FDA recommended that Reviva conduct a second Phase 3 clinical trial to generate additional efficacy data and expand brilaroxazine’s safety database.

- The company plans to initiate the RECOVER-2 Phase 3 registrational trial in the first half of 2026.

- The company’s current estimates project that the trial cost will be around $60 million.

Shares of Reviva Pharmaceuticals Holdings (RVPH) plunged more than 50% on Tuesday after the FDA called for an additional Phase 3 trial of the company’s schizophrenia treatment drug, dealing a significant setback to its regulatory timeline.

In written feedback, the FDA recommended that Reviva conduct a second Phase 3 clinical trial to generate additional efficacy data and further expand brilaroxazine’s safety database before submitting a new drug application (NDA).

Subject to sufficient financing, the company plans to initiate the RECOVER-2 Phase 3 registrational trial in the first half of 2026. The study is expected to mirror the design of the completed RECOVER Phase 3 trial. The FDA also provided guidance on data analysis and presentation, as well as requirements for animal pharmacokinetics, human abuse potential, and renal and hepatic impairment studies.

Cost Of The Trial

According to an SEC filing, the company’s current estimates project the trial cost at around $60 million, consisting of roughly $35 million in direct trial costs and approximately $24 million in general and administrative expenses.

The FDA’s recommendation follows its review of two completed randomized, double-blind, placebo-controlled studies, including one Phase 2 and one Phase 3 trial with a one-year open-label extension. Across these studies, brilaroxazine demonstrated efficacy across major schizophrenia symptom domains, including negative symptoms, in 790 participants, Reviva added.

At a meeting on December 18, Reviva shareholders approved the reverse stock split charter amendment, allowing the board to implement a 1-for-2 to 1-for-20 split at its discretion before Dec. 31, 2026. Companies generally use a reverse split to meet the $1.00 minimum bid price requirement under Nasdaq listing compliance.

How Did Stocktwits Users React?

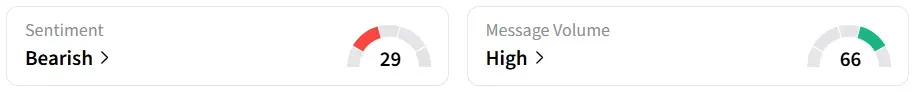

Retail sentiment for RVPH on Stocktwits remained in the ‘bearish’ territory over the past 24 hours, amid ‘high’ message volumes.

One user opined on how the company could raise funds to cover the trial costs.

Another user speculated about the trial timelines.

Read also: Spot Silver Crosses $70 An Ounce For The First Time

For updates and corrections, email newsroom[at]stocktwits[dot]com<