Cooper Companies shares rallied in pre-market trading on Friday after multiple price target revisions following a strategic review and upbeat earnings.

- JPMorgan revised the price target on COO to $78 from $66, and Baird raised it to $98 from $85.

- Mizuho, Stifel, and Piper Sandler also revised their targets higher.

- Cooper Companies reported fourth-quarter earnings on Thursday, which surpassed Wall Street expectations.

Shares of Cooper Companies Inc. (COO) rose over 13% in pre-market trading on Friday amid upward price target revisions from multiple analysts following the announcement of the company’s earnings as well as a strategic review to drive long-term shareholder value.

Cooper Companies stated that its Board and Management are conducting a formal and comprehensive strategic review of the businesses, corporate structure, strategy, operations, and capital allocation priorities to identify additional opportunities to simplify the company’s business and unlock long-term value.

The firm said during this period it expects to focus capital deployment on repurchasing shares under the recently announced $2 billion share repurchase program.

Wall Street Action

On Friday, JPMorgan raised its target price on COO to $78 from $66 with a ‘Neutral’ rating, while Baird revised its price target to $98 from $85 with an ‘Outperform’ rating. Mizuho, Stifel, and Piper Sandler also revised their targets higher.

Meanwhile, Cooper Companies reported its fourth-quarter (Q4) results that surpassed analyst expectations. The company reported quarterly revenue of $1.1 billion, up 5% from the same period last year, and earnings per share (EPS) of $1.15, 11% higher than Q4 2024.

For FY26, the firm expects revenue of $4.29 billion to $4.34 billion and diluted earnings per share (EPS) of $4.45 to $4.60. JPMorgan analyst Robbie Marcus said in a note that the company's initial FY26 outlook "sets a high bar" for earnings as it initiates the formal strategic review.

How Did Stocktwits Users React?

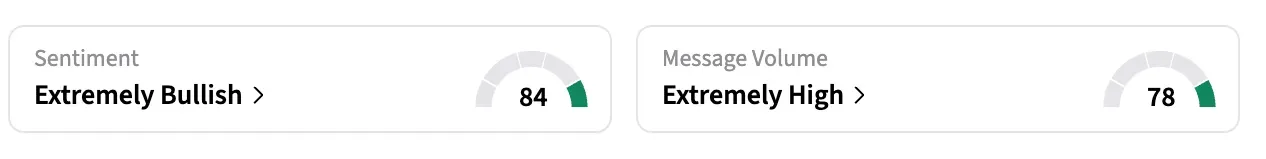

On Stocktwits, retail sentiment toward the stock shifted to ‘extremely bullish’ from ‘neutral’, while message volume jumped to ‘extremely high’.

COO shares have lost over 25% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<