New Fortress Energy is exploring a potential debt restructuring known as a scheme of arrangement in the UK, Bloomberg reported last week

- NFE stock has declined in nine of the past 10 sessions

- NFE shares have fallen 40% over the past 10 sessions

- The company is expected to post a quarterly loss on November 6

Shares of debt-laden New Fortress Energy, Inc. (NFE) are up 20% in premarket trade on Tuesday, after hitting an all-time low in the previous session. The beleaguered energy infrastructure firm has been under heavy pressure lately, with the stock declining in nine of the past 10 sessions and its value dropping by 40%.

Q3 Expectations

New Fortress Energy is expected to post a loss of $0.32 per share for the third quarter on November 6, despite a higher quarterly revenue. Analysts project a 26.3% year-over-year rise in revenue to $716.9 million, according to LSEG data. Analyst sentiment remains cautious, with an average rating of “hold,” comprising one “buy,” three “hold,” and one “sell” recommendation.

Debt Restructuring

New Fortress Energy is exploring a potential debt restructuring through a UK court process known as a scheme of arrangement, Bloomberg reported last week. The option is seen as a less costly and disruptive alternative to a U.S. Chapter 11 bankruptcy, potentially allowing the company to preserve contract relationships and retain some shareholder value.

The energy company, which operates across several countries including the UK, has faced mounting financial strain amid delayed projects that have weakened cash flow and burdened its balance sheet. New Fortress has been in private negotiations with a group of creditors to develop a restructuring plan aimed at reducing its sizable debt load.

New Fortress faces key debt payments next month, including a coupon on the $2.7 billion 2029 notes.

What Are Stocktwits Users Saying?

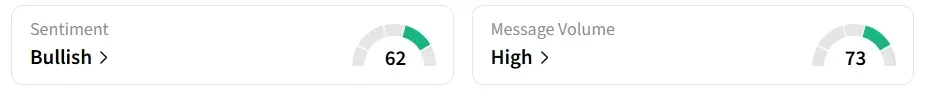

Retail sentiment on Stocktwits switched to ‘bullish’ from ‘bearish’ a session back, accompanied by ‘high’ message volumes.

One user believes that the stock has significant upside potential.

Year-to-date, the stock has shed a staggering 92%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<