Wells Fargo’s fourth-quarter revenue of $21.29 billion fell short of Wall Street estimates of $21.68 billion, according to Fiscal.ai data.

- Net income reached $5.4 billion, or $1.62 per diluted share, below street estimates of $1.69 per share.

- Excluding a severance expense of $461 million, earnings per share would increase to $1.76, the bank said.

- Wells Fargo expects net interest income for 2026 to rise to $50 billion.

Wells Fargo’s (WFC) shares fell over 2.5% in premarket trading on Wednesday after the banking firm reported a revenue of $21.29 billion, which fell short of Wall Street estimates of $21.68 billion, according to Fiscal.ai data.

Net interest income increased 4% year over year to $12.3 billion, benefiting from higher loan balances and asset repricing, though deposit mix pressures capped gains. The bank’s average loans increased 5% to $955.8 billion, and deposits rose 2% to $1.4 trillion.

Net income reached $5.4 billion, or $1.62 per diluted share, below street estimates of $1.69 per share. However, excluding a severance expense of $461 million, net income would increase to $5.8 billion and diluted earnings per share to $1.76, Wells Fargo added.

2026 Outlook

Looking ahead, Wells Fargo expects 2026 net interest income to rise to $50 billion from $47.5 billion this year, supported by balance sheet growth, loan and deposit mix shifts, and continued fixed-rate asset repricing. Expenses for 2026 are projected to reflect lower severance, but higher Wealth & Investment Management costs, as well as investments in technology and operations, the company added.

“Evidence of increased growth can be seen across the company. In our consumer businesses, credit card continues to see strong increases in spend and new accounts grew over 20% from a year ago. Auto lending returned to growth with balances up 19% from the prior year,” said Charlie Scharf, Chairman and CEO.

“Net checking account growth was stronger and deposits and investment balances in our affluent offering – Wells Fargo Premier grew 14% from the prior year. Advisory fees in our Wealth and Investment Management business grew 8%. In our commercial businesses, loans grew 12%. Investment banking fees increased 14%. We grew investment banking market share and our M&A ranking increased from 12 to 8,” Scharf added.

Segment-wise Breakdown

Revenue in Consumer Banking and Lending, which provides checking, savings, credit cards, and loans, rose 7%, driven by higher loan and deposit balances. Commercial Banking, serving private, family-owned, and public companies, saw revenue decline 3% due to lower interest rates.

Corporate & Investment Banking’s revenue remained largely flat, while Wealth and Investment Management generated $4.4 billion, up 10%, supported by stronger asset management fees and loan growth.

How Did Stocktwits Users React?

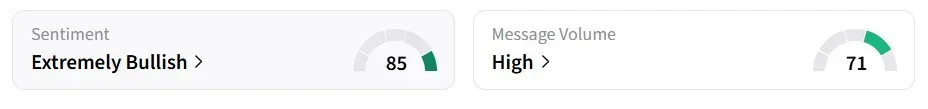

Despite the premarket decline, retail sentiment for WFC stock turned ‘extremely bullish’ from ‘bullish’ a day earlier, accompanied by ‘high’ message volumes.

One user said that the stock’s drawdown presents a nice entry point.

Over the past year, the stock has gained nearly 34%.

Read also: Eos Energy Sparks Retail Buzz After New Battery Storage Platform Launch

For updates and corrections, email newsroom[at]stocktwits[dot]com.<