Several major investors pointed to CEO Oliver Blume’s role as head of both Volkswagen and Porsche as the reason, Reuters reported.

Shareholders of German automaker Volkswagen (VWAGY) criticized the company’s corporate governance on Friday at its virtual annual general meeting, Reuters reported on Friday.

Several major investors pointed to CEO Oliver Blume’s role as head of both Volkswagen and Porsche. Porsche was listed as a separate company in September 2022, but Blume is the CEO of both.

Ingo Speich of Deka Investment appealed to Blume to give up one of his board positions and added that conflicts of interest across the carmaker’s governance structure were "highly problematic" and caused "grave damage to reputation and enormous financial losses," as per Reuters.

Blume, however, defended his dual role, saying it benefited the cost-cutting measures underway at the two companies and termed it “a recipe for success.” He also noted that the dual role is not intended to last forever.

Four investors on Friday also alleged that a lack of expertise on the board in key competencies like electrification or digitalization was holding the carmaker back.

Volkswagen is controlled by the Porsche and Piech families through their holding firm Porsche SE, which holds most voting rights in the automaker, Reuters noted.

The report added that the leader of Porsche SE's supervisory board had previously dismissed poor governance allegations and pinned the company’s falling share price to weak performance and high costs.

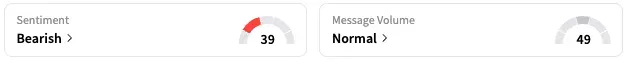

On Stocktwits, retail sentiment around VWAGY fell from ‘neutral’ to ‘bearish’ territory over the past 24 hours while message volume remained at ‘normal’ levels.

VWAGY is up by over 28% this year but has fallen by about 23% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<