The package delivery giant forecast 2026 revenue of about $89.7 billion, and guided for a non-GAAP adjusted operating margin of 9.6%.

- UPS' FY 2025 revenue came in at $88.7 billion, above estimates of $87.95 billion, according to Fiscal.ai data.

- UPS’ Q4 revenue came in at $24.5 billion, above Wall Street’s estimates of $24 billion

- CFO Brian Dykes said the company expects to reduce total operational hours by about 25 million.

United Parcel Service (UPS) shares jumped nearly 4% in pre-market trading on Tuesday after the company delivered better-than-expected fourth-quarter and full-year 2025 results, issued an upbeat outlook for 2026, and announced 30,000 job cuts this year.

The stock gave up some of its early gains after the opening bell and was up 2.5% at the time of writing.

The package delivery giant forecast 2026 revenue of about $89.7 billion, and guided for a non-GAAP adjusted operating margin of 9.6%. FY 2025 revenue came in at $88.7 billion, above estimates of $87.95 billion, according to Fiscal.ai data.

UPS’ Q4 revenue came in at $24.5 billion, above Wall Street’s estimates of $24 billion, while adjusted earnings per share were $2.38, compared to analysts’ estimates of $2.1.

“Looking ahead, upon completion of the Amazon glide-down, 2026 will be an inflection point in the execution of our strategy to deliver growth and sustained margin expansion,” said Carol Tomé, UPS chief executive officer.

Job Cuts

United Parcel Service plans to cut an additional 30,000 jobs this year as it winds down its partnership with Amazon. CFO Brian Dykes said the company expects to reduce total operational hours by about 25 million.

“Looking at the variable costs associated with the Amazon volume decline, in 2026, we plan to reduce total operational hours by approximately 25 million hours. In terms of semi-variable costs, we expect to reduce operational positions by up to 30,000. This will be accomplished through attrition, and we expect to offer a second voluntary separation program for full-time drivers,” Dykes said in a call with analysts.

UPS said in January last year it would speed up cuts to millions of low-margin Amazon deliveries, calling the business highly dilutive to margins. In 2025, the company cut 48,000 jobs, offered driver buyouts, and shut down operations at 93 facilities as Amazon volumes declined.

Retail Reaction

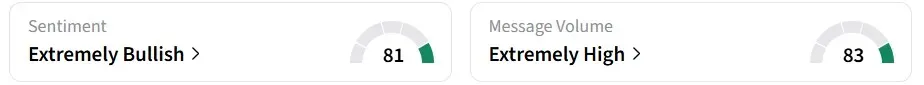

Retail sentiment on Stocktwits flipped to 'extremely bullish' from 'neutral' a day earlier, amid 'extremely high' message volumes.

One bullish user expects UPS stock to climb to $150.

The stock has declined 17% over the past year but is up more than 11% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<