Uber shares slid as regulators escalated a subscription lawsuit, while retail investors called the dip a buy.

- Regulators accuse Uber of misleading billing, missing promised savings, and making subscriptions hard to cancel, seeking civil penalties.

- The lawsuit has expanded from the FTC’s initial filing into a broader multi-state case, adding to Uber’s legal pressure.

- Retail traders remain bullish, with many viewing the selloff as a buying opportunity.

Uber shares slid toward their lowest levels in seven months after a U.S. consumer regulator, joined by 21 states and the District of Columbia, escalated a lawsuit alleging deceptive billing and hard-to-cancel subscription practices tied to the company’s Uber One program.

At the time of writing, Uber shares were down 3.4% at $82.27.

Amended Complaint Escalates Case

The amended complaint, filed by the Federal Trade Commission and state attorneys general, seeks civil penalties and alleges Uber charged users without clear consent, failed to deliver advertised savings such as zero delivery fees, and charged cancellation fees difficult despite claims that users can “cancel anytime.” Regulators say some customers were billed before their stated billing dates, including during free trials, or charged despite never knowingly signing up.

April: FTC Files Initial Lawsuit

The case traces back to April, when the FTC first sued Uber over alleged “deceptive billing and cancellation practices” related to Uber One. The agency alleged consumers were enrolled without consent, did not receive promised savings, and faced a complex cancellation process. FTC Chairman Andrew Ferguson said at the time that consumers were frustrated by subscriptions that are difficult to cancel. Uber then said it was disappointed by the action and maintained that its sign-up and cancellation processes are clear and compliant with the law.

July: Allegations Expanded

In July, the FTC added further detail to its claims, alleging some users were charged even before their billing dates and that free-trial users were automatically billed before trials ended. The agency said users could be forced to navigate numerous screens and actions to cancel. Uber reiterated that its processes are lawful and transparent.

Uber Faces Separate DOJ Lawsuit

Uber has also faced legal pressure on another front. In September, the U.S. Department of Justice filed a lawsuit against the company for discriminating against people with physical disabilities, in incidents which included refusals to serve riders using stowable wheelchairs or when traveling with service animals. The company denied the allegations, and stated that it has a zero-tolerance policy for such behavior, and requires drivers to comply with accessibility regulations.

Uber has also settled previous disability-related claims, including an agreement in 2021 to pay more than $2 million, and waive certain wait-time fees for eligible riders.

How Did Stocktwits Users React?

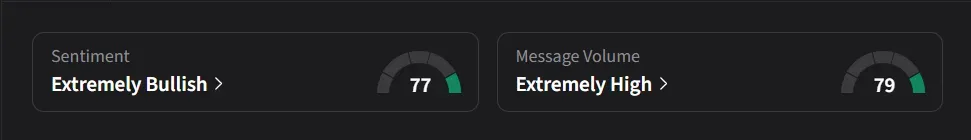

On Stocktwits, retail sentiment for Uber was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “I think this is my best pick so far for next year…they are profitable as is and in 10 years with autonomous??”

Another user said the stock is “OVERSOLD BUY THE FEAR!!!!”

Uber’s stock has risen 36% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<