Two major firms, Wedbush and Stifel, sharply raised their price targets, signaling stronger pricing trends and improving demand in the memory chip market.

- Wedbush raised its price target on Micron shares to $300 from $220 while maintaining an ‘Outperform’ rating.

- Stifel lifted its target to $300 from $195 and reiterated a ‘Buy’ rating.

- According to Fiscal AI data, analysts estimate a Q1 revenue of $12.86 billion and an EPS of $3.91 for Micron.

Micron Technology Inc. (MU) is drawing optimism from Wall Street ahead of the company’s upcoming first-quarter fiscal 2026 earnings scheduled for Wednesday.

Wedbush and Stifel lifted their price targets for the stock by about 50%, signaling stronger pricing trends and improving demand in the memory chip market.

Wedbush raised its price target to $300 from $220 while maintaining an ‘Outperform’ rating, according to TheFly. The firm said improving supply-demand dynamics in memory markets position Micron for a larger-than-expected increase in average selling prices.

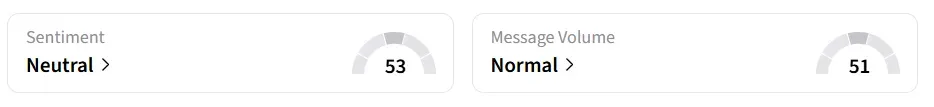

Micron Technology’s stock traded over 1% higher on Monday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Stifel Flags AI-Driven Demand Surge

Stifel lifted its target to $300 from $195 and reiterated a ‘Buy’ rating. The firm pointed to accelerating investment in artificial intelligence infrastructure as a key driver of higher memory prices toward year-end.

The firm described AI demand as a turning point for the industry and expects Micron to deliver results above consensus for Q1, along with a stronger-than-anticipated outlook for the second quarter (Q2).

Stifel also noted that Micron’s focus on profitability improvements and bit optimization supports a constructive view of the stock.

Guidance

For Q1, Micron anticipates revenue of $12.50 billion (+/-$300 million) and earnings per share of $3.56 (+/-$0.15). According to Fiscal AI data, analysts estimate a Q1 revenue of $12.86 billion and an EPS of $3.91.

Micron offers a range of high-performance DRAM, NAND, and NOR memory and storage products under its Micron and Crucial brands.

MU stock has gained over 190% in 2025 and over 126% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<