Rivian received two price target upgrades, from Goldman Sachs and Needham, following multiple announcements at its AI and autonomy event.

- Goldman Sachs increased Rivian’s price target to $16 from $13 while maintaining a ‘Neutral’ rating, citing confidence in new car updates.

- Needham revised the automaker’s price target upwards to $23 from $14 and reiterated a ‘Buy’ rating.

- Meanwhile, RBC Capital maintained its ‘Sector Perform’ rating and reaffirmed the $14 price target.

Rivian Automotive Inc. (RIVN) shares rallied on Friday after Goldman Sachs and Needham raised their price targets on the electric vehicle company.

Goldman Sachs raised the price target on Rivian to $16 from $13 while maintaining a ‘Neutral’ rating, according to TheFly. Needham increased its price target on the firm to $23 from $14 and reiterated a ‘Buy’ rating.

The upgrades come after Rivian’s AI and autonomy event in California, where the automaker announced the development of its own proprietary silicon chip to replace Nvidia’s and its latest computer model, among other updates.

Shares of RIVN surged over 17% during market hours at the time of writing.

Meanwhile, RBC Capital maintained its ‘Sector Perform’ rating and reiterated the $14 price target after the event.

Analyst Takes

Goldman Sachs said it revised Rivian’s target upwards because it views the new car updates announced at the event as a platform for high-margin software, with future opportunities in advanced autonomy, third-party integrations, and potentially broader licensing.

Needham’s rationale for its upgrade is its increased confidence in Rivian following its vertical integration announcement that would allow for fuller control, faster learning, and feature iterations across driver interface and autonomy technology, resulting in "durable competitive advantage", as cited in TheFly.

However, RBC said that while Autonomy+ could potentially boost margins, it would still risk low take-rates sans an eyes-off solution. The firm also expressed concerns about the lack of clarity on Rivian’s liquidity concerns and R2/R3 profitability.

The Big Reveal

In Thursday’s event, the company announced the development of a custom chip called RAP1 or Rivian Autonomy Processor 1, which would aid the automaker in achieving level 4 vehicle autonomy. So far, Rivian’s older car system employed Nvidia Orin chips.

This chip will power Rivian’s third-generation compute module, the Gen 3 Autonomy Computer, which the company said would achieve 1600 sparse INT8 TOPS (trillion operations per second). This will enable the new system to process five billion pixels per second.

In addition, the company said it planned to launch an Autonomy+ subscription in early 2026 for its next-gen customers. The software update would introduce universal hands-free driving for its customers, priced at $49.99 per month or a one-time price of $2,500.

How Did Stocktwits Users React?

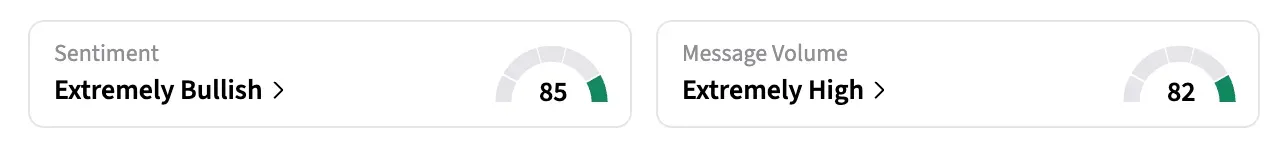

On Stocktwits, RIVN was among the top trending stocks on Friday morning. The retail sentiment around RIVN jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours, while message volume increased from ‘normal’ to ‘extremely high’ at the time of writing.

One Stocktwits user said they would hold the stock even though some others might book a profit on the price rise.

Another user commented that this wasn’t a shorts event but a result of people just realizing Rivian’s potential to become the most sought-after affordable car brand in the West.

Shares of RIVN are up over 42% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<