Fermi and the tenant had signed a letter of intent in September to lease a portion of the Project Matador Site.

- The agreement fell through after the exclusivity period outlined in the letter of intent expired at midnight on Dec. 9.

- The company founded by former U.S. Energy Secretary Rick Perry said that it has commenced discussions with several other potential tenants for power delivery at the Project Matador Site in 2026.

- Fermi, launched in January 2025, is setting out to build what it hopes will become the world’s largest combined energy and data campus.

Rick Perry’s Fermi America stock dropped over 46% in premarket trading on Friday after the company said an investment-grade-rated tenant has terminated an agreement to provide $150 million to fund construction costs of its Matador project.

Fermi and the tenant had signed a letter of intent in September to lease a portion of the Project Matador Site, subject to negotiation and execution of a definitive lease agreement. In November, the companies signed the Advance in Aid of Construction Agreement (AICA), which fetched Fermi the funding.

Negotiations Still Ongoing

The agreement fell through after the exclusivity period outlined in the letter of intent expired at midnight on December 9. Fermi said that on December 11, the tenant notified it of its termination of the AICA. Still, the parties continue to negotiate the terms of a lease agreement at Project Matador pursuant to the letter of intent.

The company founded by former U.S. Energy Secretary Rick Perry said that it has commenced discussions with several other potential tenants for power delivery at the Project Matador Site in 2026. It also noted that it remains confident it will meet its expected power delivery schedule at Project Matador, as demand for behind-the-meter power for AI remains robust in the near and long term.

Fermi, launched in January 2025, is setting out to build what it hopes will become the world’s largest combined energy and data campus, powered by a mix of nuclear, natural gas, and solar energy. Its main initiative, Project Matador, aims to supply up to 11 gigawatts of power to data centers by 2038.

The massive 5,236-acre site in Texas is designed to attract data center operators and major cloud providers, with the company targeting about one gigawatt of capacity to be up and running by the end of 2026. However, the firm is yet to generate any revenue.

What Are Stocktwits Users Thinking?

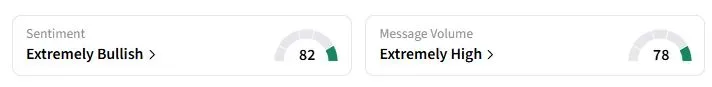

Retail sentiment on Stocktwits about Fermi was still in the ‘extremely bullish’ territory at the time of writing.

Since its blockbuster debut in October, Fermi stock has fallen 27%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<