The analyst lowered the price target on Oracle to $213 from $320 while maintaining an ‘Equal Weight’ rating on the shares.

- Morgan Stanley said in a note to investors that while it sees Oracle’s GPU-as-a-Service as "a sizable revenue opportunity," the buildout will likely push its EPS below targets and increase its funding needs.

- Morgan Stanley added that even after underperformance, it thinks the company’s own new, higher forecasts for funding needs and leverage are key risks not reflected in its credit spreads.

- On Thursday, Trump said TikTok would continue to operate in the U.S. under a proposed joint venture, with Oracle being a key cloud infrastructure partner and investor.

Oracle Corp. (ORCL) drew attention from retail investors on Friday after U.S. President Donald Trump confirmed in a social media post that TikTok would continue operating in the U.S.

Trump said on Thursday that the social media platform would operate under a proposed U.S.-China joint venture, with Oracle being a key cloud infrastructure partner and investor, owning 15% stake.

However, Morgan Stanley on Friday lowered the price target on Oracle to $213 from $320. The analyst kept an ‘Equal Weight’ rating on the shares, according to TheFly. While the target represents a 20% upside from Oracle’s current $178 level, the analyst cut it back by 33%.

Morgan Stanley’s Rationale

Morgan Stanley said in a note to investors that while it sees Oracle’s GPU-as-a-Service, or artificial intelligence infrastructure, as "a sizable revenue opportunity," its own analysis suggests that the buildout will likely push its earnings per share below targets as well as increase its funding needs.

The analyst said that it also struggles to see a viable path to Oracle's EPS targets, which it has factored into the current share price and reduced price target. Oracle reported a $2.26 non-GAAP EPS for the second-quarter (Q2) 2026 and said it anticipates a 12-14% growth in non-GAAP EPS for the following quarter.

Morgan Stanley added that even after underperformance, it thinks Oracle’s own new, higher forecasts for funding needs and leverage are key risks and are not reflected in its credit spreads. The analyst said that it recommends buying credit default swaps (CDS) and selling benchmark bonds.

The analyst made no mention of the recent TikTok deal in its note to investors.

How Did Stocktwits Users React?

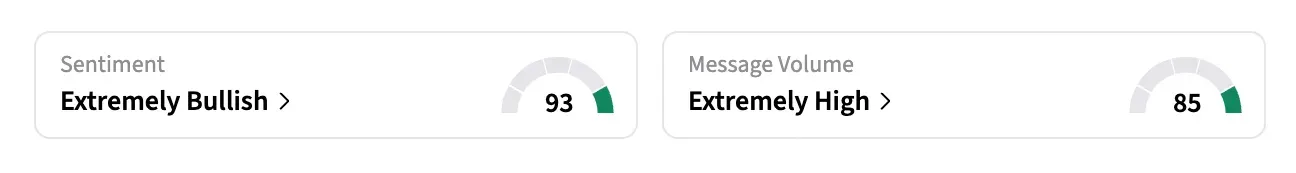

On Stocktwits, retail sentiment around ORCL shares remained in the ‘extremely bullish’ territory at the time of writing amid ‘extremely high’ message volumes.

One bullish user said the company’s stock would push past $180, and Trump’s support would raise it to over $190.

Shares of ORCL lost over 4% in the last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<