The firm downgraded the stock to ‘Equal Weight’, citing limited upside potential after a 50% rally.

Morgan Stanley analyst Keith Weiss downgraded cybersecurity giant CrowdStrike Holdings Inc. (CRWD), citing concerns that its strong rally has largely priced in upcoming growth.

As per TheFly, Weiss rated the stock as ‘Equal Weight’, down from the previous ‘Overweight’ rating and modestly raised the price target to $495 from $490, suggesting a tempered view on the cybersecurity firm's future upside.

Following the downgrade, CrowdStrike stock inched lower by 0.4% on Monday afternoon.

The firm noted that CrowdStrike shares have climbed approximately 50% from their April lows, leaving limited room for further gains.

“The expected second half of 2025 growth acceleration now looks well priced into the stock,” Weiss told investors in a research note, signaling that much of the anticipated progress is already reflected in the current valuation.

While still praising CrowdStrike’s long-term strategic positioning in cybersecurity, the analyst expressed caution around the stock’s near-term potential.

The analyst opined that despite its competitive moat and growth trajectory, the recent surge may have diminished the margin for additional upside.

The company’s first-quarter (Q1) revenue climbed 20% year over year (YoY) to $1.103 billion, slightly below the $1.105-billion consensus estimate as per Finchat data.

However, the adjusted earnings per share (EPS) of $0.73 surpassed the analysts' consensus estimate of $0.66. The company noted that the adjusted subscription gross margin contracted YoY to 80% from 81%.

CrowdStrike sees second-quarter (Q2) adjusted EPS and revenue of $0.82 to $0.84 and $1.1447 billion to $1.1516 billion, respectively.

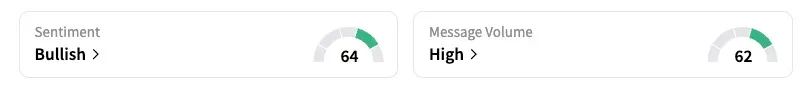

On Stocktwits, retail sentiment toward CrowdStrike remained in ‘bullish’ territory amid ‘high’ message volume levels.

CrowdStrike stock has added over 39% year-to-date and over 26% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<