Micron Technology’s high bandwidth memory chips are used in Nvidia’s Blackwell and other chips.

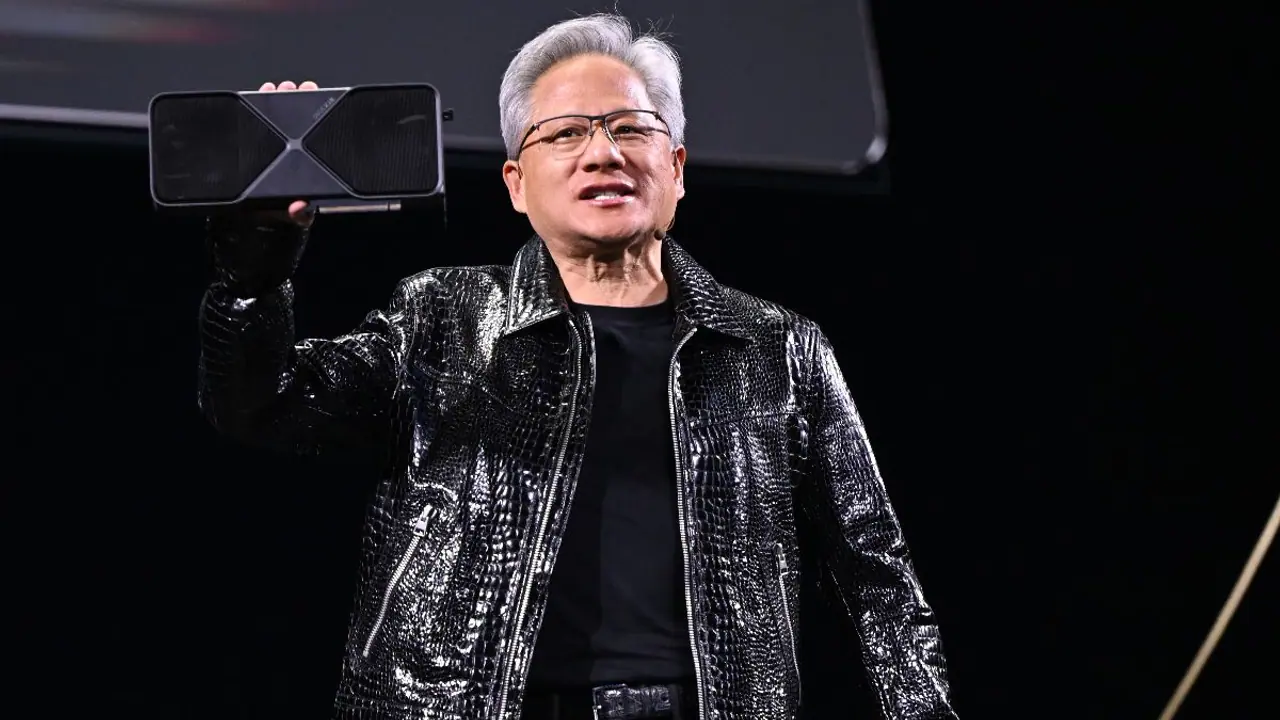

Shares of Micron Technology Inc. (MU) surged in pre-market trading on Tuesday after the company was name-dropped by Nvidia Corp. (NVDA) CEO Jensen Huang at the Consumer Electronics Show (CES) 2025.

Micron makes high bandwidth memory (HBM) chips which are included in Nvidia’s H200 processors, as well as its more-recent Blackwell chips.

“The [graphics processing unit] in our new GeForce RTX 50 series Blackwell architecture is just a beast. [We're getting] G7 memory from Micron of 1.8 terabytes per second, twice the performance of our last generation and we now have the ability to intermix AI workloads with computer graphics workloads,” said Huang.

Micron CEO Sanjay Mehrotra called demand for HBM chips “transformational” for the Boise, Idaho-based company.

Nvidia also announced a new $3,000 computer called “Project Digits” that is powered by the GB10 Grace Blackwell superchip – Micron also provides memory for this chip.

This computer features 128GB low-power DDR5X high bandwidth memory made by Micron.

Reacting to the news, Micron stock price gained over 4% in pre-market trading.

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (76/100) territory, while message volume was in the ‘high’ zone at the time of writing.

Users were optimistic about Micron stock’s prospects, with one saying they raised their “personal” price target from $120 to $150.

Meanwhile, one user pointed out that Nvidia using Micron memory is not a new thing.

However, another user thinks Huang’s comments are indicative of where investors should “put” their cash.

Micron’s stock has declined more than 24% in the past six months. But it is up nearly 17% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<