SEBI-registered analyst Prameela urges investors to wait for dips, citing better risk-reward entry zones.

Shares of Mahindra & Mahindra (M&M) gained in trade on Tuesday, outperforming broader markets and coming within 6% of its all-time high.

The stock has rallied over 22% in the last 20 sessions, fueled by robust Q4 earnings, improving demand outlook, and continued leadership in the utility vehicle (UV) and farm equipment space.

Notably, M&M is among the few Nifty stocks with zero “Sell” calls. Out of 41 analysts tracking the stock, 39 rate it a “Buy” and the remaining two call it a “Hold,” reflecting a rare and overwhelming vote of confidence from institutional investors.

Several global and domestic brokerages remain bullish on M&M. Macquarie retained its ‘Outperform’ rating with a price target of ₹3,470, indicating a potential 15% upside.

Motilal Oswal has raised its FY26/FY27 estimates by 4–6% and reiterated a buy with a target of ₹3,482.

ICICI Securities upgraded the stock to ‘Buy’ with a revised target of ₹3,500, citing improved volume growth and margins.

However, JM Financial has taken a more cautious stance, maintaining a ‘Hold’ rating with a target of ₹2,760 due to near-term pressure on margins in both auto and farm segments.

SEBI-registered analyst Prameela Balakkala too views M&M as a “buy on dips” candidate. The stock’s rally of over 22% makes it a high-momentum play, but chasing it at elevated levels may not offer the best risk-reward, she warns.

Balakkala advises traders to wait for healthy pullbacks, as momentum names often face short-term profit-taking after extended uptrends.

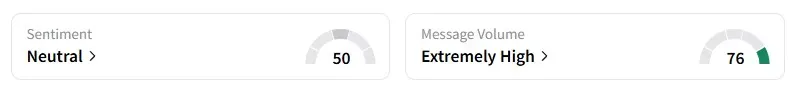

Data on Stocktwits shows that retail sentiment remains ‘neutral’ on this stock.

M&M shares up 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<