UBS analysts said the price target cut was due to lower gross margin assumptions, as Lennar maintains elevated incentive levels.

Lennar (LEN) received a couple of price target cuts from brokerages amid declining margins for the homebuilder.

According to TheFly, UBS cut Lennar's price target (PT) to $164 from $183 and maintained a ‘Buy’ rating on the shares. The new PT still implies about 42% upside to the stock’s last close.

This brokerage said the cut was due to lower gross margin assumptions, as Lennar maintains elevated incentive levels to support its even-flow production model.

Elevated mortgage rates and sticky inflation have weighed on new home sales, forcing builders to offer incentives to attract buyers.

UBS said it believes the company's operating strategy will "bear fruit over time" and that expectations have been reset to reflect the near-term challenges.

As per TheFly, BofA analysts trimmed the price target to $124 from $130 while maintaining a ‘Neutral’ rating on the stock. The new PT implies an upside of 7.6% compared to the stock’s Friday closing price.

The brokerage sees more upside in other homebuilder stocks with higher return on equity profiles, which are trading at similar or less expensive valuations.

The company’s fiscal first quarter gross margins on home sales fell to $1.4 billion, or 18.7%, from $1.5 billion, or 21.8%, hurt by a rise in land costs year over year and a decrease in revenue per square foot.

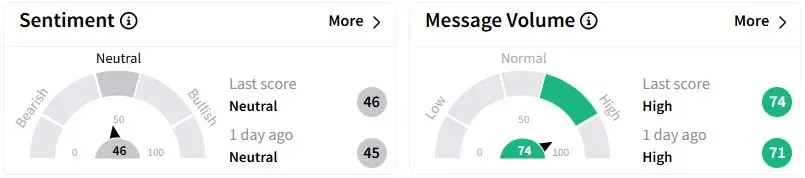

Retail sentiment on Stocktwits remained in the ‘neutral’ (46/100) territory than a day ago, while retail chatter was ‘high.’

The company had forecasted second–quarter new orders between 22,500 and 23,500 and deliveries between 19,500 and 20,500.

The firm expects the average sales price to fall into the range of $390,000 to $400,000.

Lennar shares have fallen 12.7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<