Stocktwits data shows that retail sentiment is also improving, reinforcing the bullish outlook.

Two financial stocks are flashing green on the charts. SEBI-registered analyst Palak Jain is bullish on JM Financial and Bajaj Finance, driven by strong technical indicators. She anticipates a breakout in both these counters.

Let’s take a look at the rationale behind her recommendations:

JM Financial

Jain noted that JM Financial’s share price has shown a significant increase from May to July. The stock is currently consolidating between support at ₹150 and resistance at ₹180 levels, with a good volume buildu, indicating the potential for a breakout.

The Directional Movement Index (DMI) also suggests a strong trend. Jain believes that the stock is likely to break out above the resistance level, making it a potential buy.

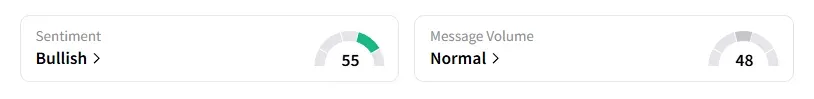

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago.

JM Financial shares have risen 39% year-to-date (YTD).

Bajaj Finance

Jain observed that Bajaj Finance is forming an ascending triangle pattern, a bullish technical indicator signaling a potential breakout. Additionally, its support level is rising, which shows increasing demand and a potential for the stock to move higher.

She added that a breakout above the resistance level (around ₹970) can lead to a significant price movement.

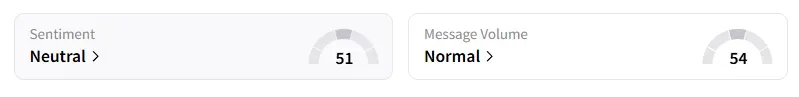

Data on Stocktwits shows that retail sentiment moved from ‘bearish’ to ‘neutral’ a day ago.

Bajaj Finance shares have risen 41% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<