Indian benchmark indices opened in the green on Monday, led by gains in oil & gas, FMCG, and IT stocks.

Indian stock markets were in the green in early trading on Monday, with headline indices showing some strength.

Around 9:35 a.m. IST, the benchmark Nifty rose above 24,400, and the Sensex gained 275 points to 80,777. Broader markets outperformed.

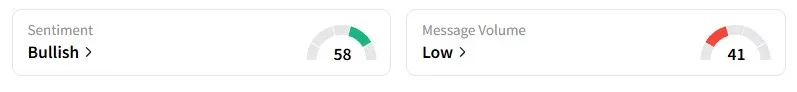

Data on Stocktwits shows that retail sentiment for the Nifty 50 remained 'bullish.'

Most sectors were trading positively, with oil & gas, FMCG, and IT stocks showing the most significant gains. Conversely, public-sector banks and real estate stocks were facing downward pressure.

Shares of State Bank of India, the country's largest lender by assets, opened 1% lower following a mixed quarterly earnings report. Despite a decrease in net profit, the bank reported strong loan growth. SBI has revised its margin guidance downward from 14-16% to 12-13%.

Kotak Mahindra Bank's stock declined by 5% due to reduced fourth-quarter profitability due to issues in its microfinance unit and a resulting decrease in agriculture and rural lending.

D-Mart parent Avenue Supermarts Ltd's shares fell 3% as its weak operational performance in the fourth quarter weighed on investor sentiment.

Tata Motors gained 1% following reports indicating that its Jaguar Land Rover (JLR) division has restarted vehicle shipments to the United States.

Adani Ports saw 3% gains. Bloomberg reported that representatives for Gautam Adani and his companies met with Trump administration officials regarding the dismissal of overseas bribery charges against him. These talks could lead to a resolution in the coming month.

Investors will monitor M&M, CAMS, Indian Hotels, and Coforge as they report quarterly numbers later in the day.

SEBI-registered research advisors shared the day's trade set-up on Stocktwits.

Mayank Singh Chandel identified immediate resistance for Nifty at 24,450–24,600, and a decisive close above this range could allow the index to test higher levels, potentially reaching 25,000 within the month.

On the downside, he pegs support at 24,200, followed by 24,000; a breach below these levels may signal a shift in market sentiment and lead to further consolidation.

For trading strategy, Chandel recommends initiating long positions only after a decisive close above 24,450 to confirm the continuation of the uptrend.

At the same time, a failure to sustain above 24,200 could warrant a more cautious approach as it may indicate the start of a consolidation phase.

Chandel said tight stop-loss orders are advised to manage potential volatility, especially given the proximity to key resistance levels.

According to him, key levels to watch include resistance at 24,450, 24,600, and 24,800, and support at 24,200 and 24,000.

Prabhat Mittal identified Nifty support at 24,250 and resistance at 24,520. For Bank Nifty, he pointed to support at 54,700 and resistance at 55,600.

Most Asian markets are shut on Monday due to the observance of Labor Day.

Meanwhile, the Dow Futures edged lower as investors closely watched the Fed meet and host of earnings this week. President Trump indicated a possible change in US trade strategy on the tariffs front, stating his willingness to reduce duties on Chinese goods.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<