Hyundai Motor India shares surged past their key resistance, signaling further upside toward ₹2,040, supported by strong Q4FY25 earnings and a low debt-to-equity ratio, according to SEBI-registered analyst Harika Enjamuri.

Hyundai Motor India Ltd has been a disappointing bet for investors as the stock failed to show sustained growth since its market debut last October.

However, SEBI-registered analyst Harika Enjamuri indicates that a technical turnaround might emerge.

Since its debut at ₹1,934 fell short of its IPO price of ₹1,960, the stock has not been able to establish upward traction, remaining below its initial issue price for many months.

On April 7, the stock price plummeted to its lowest point in 52 weeks, reaching ₹1,541.70.

Enjamuri said that Hyundai Motor India has recently broke through the critical resistance zone between ₹1,800 and ₹1,820, which now supports future price movements.

At the time of writing, Hyundai Motor India Ltd shares were trading marginally lower at ₹1,854.20, down ₹1.40 or 0.075% in volatile trading.

The stock's daily chart displays a bullish crossover pattern because the 9-day exponential moving average surpassed the 70-day and 100-day simple moving averages, Enjamuri said.

Positive momentum indicators show an Relative Strength Index (RSI) value of 70.32, which suggests an overbought situation that might trigger temporary consolidation or profit booking near the resistance level at ₹1,928.

According to Enjamuri's weekly chart analysis, the RSI level 57.74 shows potential for stock price improvement.

The market uptrend strengthens as a long bullish candle forms alongside increasing trading volume.

The stock's next potential upside target will reach ₹2,040 if it holds above ₹1,928.

She advised investors that although the positive trend continues through the short to medium term, it could reverse to test ₹1,800 and ₹1,770 levels if the price drops below ₹1,840.

The bullish pattern holds until ₹1,770 experiences a decisive breach.

Fundamentally, Hyundai continues to report solid numbers.

Hyundai hit standalone revenue of ₹17,562 crore and operating margins of 14% in Q4FY25, resulting in a net profit rise to ₹1,583 crore and an EPS growth to ₹19.48.

Enjamuri said that the company attracts investors through its substantial domestic market share, growing electric vehicle initiatives, and robust financial indicators demonstrated by a debt-to-equity ratio of 0.05 and an ROCE of 54.2%.

The upcoming expansion of Hyundai through battery assembly unit construction and Talegaon plant establishment will enable the company to reach an annual production capacity of 1.07 million units by 2026.

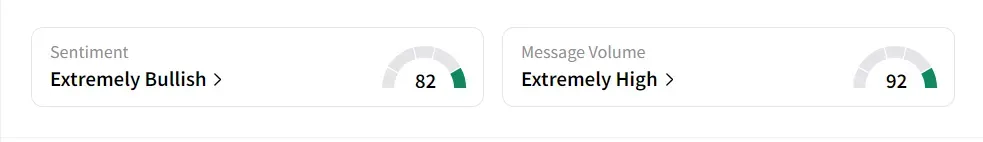

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

The stock has risen 3.3% so far in 2025, but is still more than 5% below its issue price of ₹1,960.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<