AMD outpaced Nvidia as accelerating data-center growth, inference strength, and valuation asymmetry drove outsized gains, even while Nvidia retained dominance in AI chips.

- While Nvidia still controls the bulk of AI accelerator revenue, AMD is growing faster off a smaller base, winning incremental data-center and inference workloads.

- Inference economics and product momentum have improved AMD’s competitive standing.

- Despite trading at a higher forward P/E, AMD appears cheaper on a price-to-sales basis and is less exposed to concerns about circular deals.

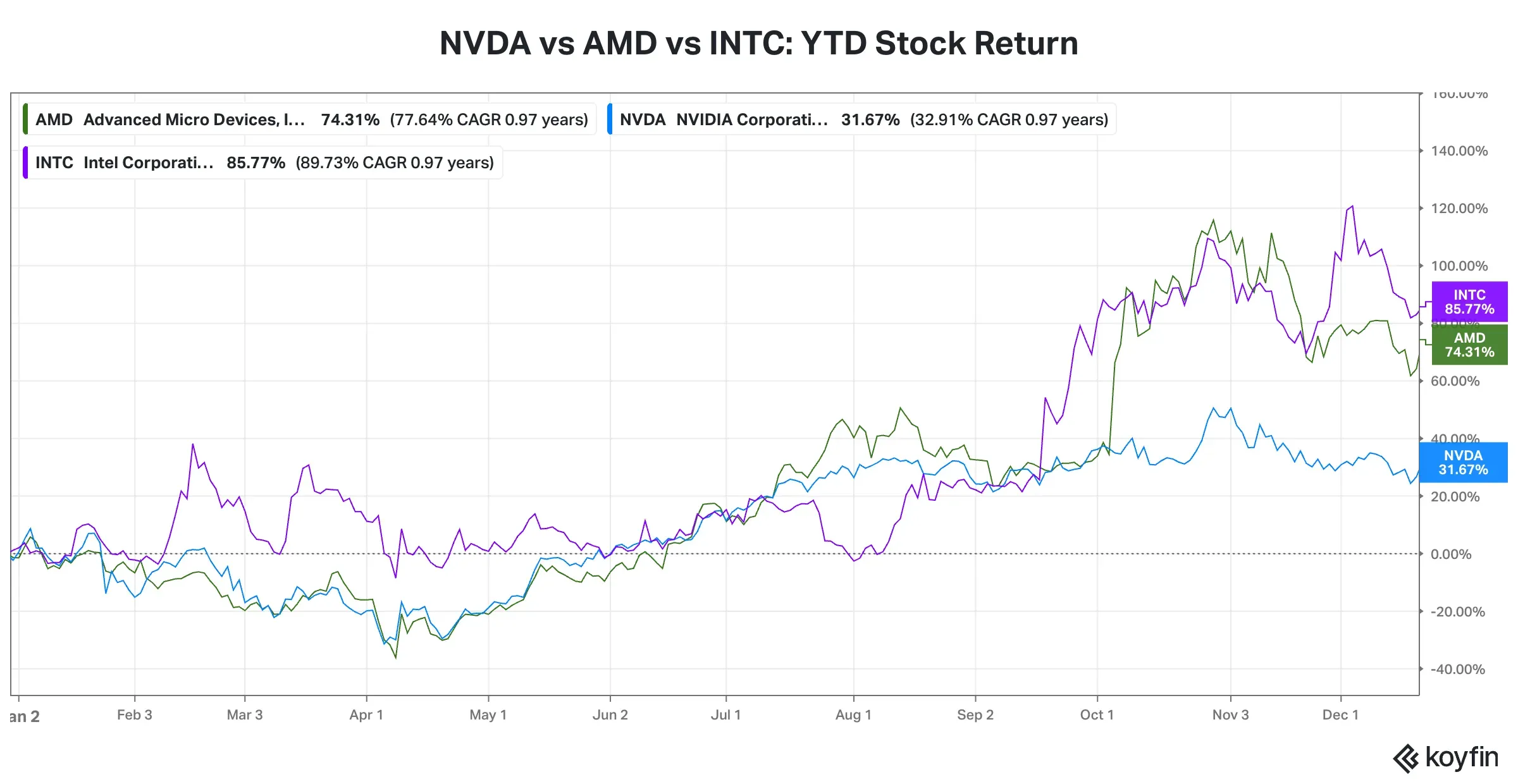

The growth in Advanced Micro Devices (AMD) shares has been more than twice as good as Wall Street’s artificial intelligence (AI) darling Nvidia Corp. (NVDA) this year, even though the smaller chipmaker was relatively late to the AI party.

Known for its fightbacks, AMD was not cowed down, but slowly and steadily made inroads. And the result is for everyone to see. AMD’s stock has gained more than 74% year-to-date, relative to Nvidia stock’s approximately 32% gain, as the company’s revenue trajectory has been broadly upward as it began to eat into the latter’s AI accelerator market share and was quick with its product launches.

Does the outperformance mean AMD is gaining some traction in the AI chip race? How will the Nvidia vs AMD rivalry pan out in the new year?

1. AMD vs. Nvidia: The Data Center Duel

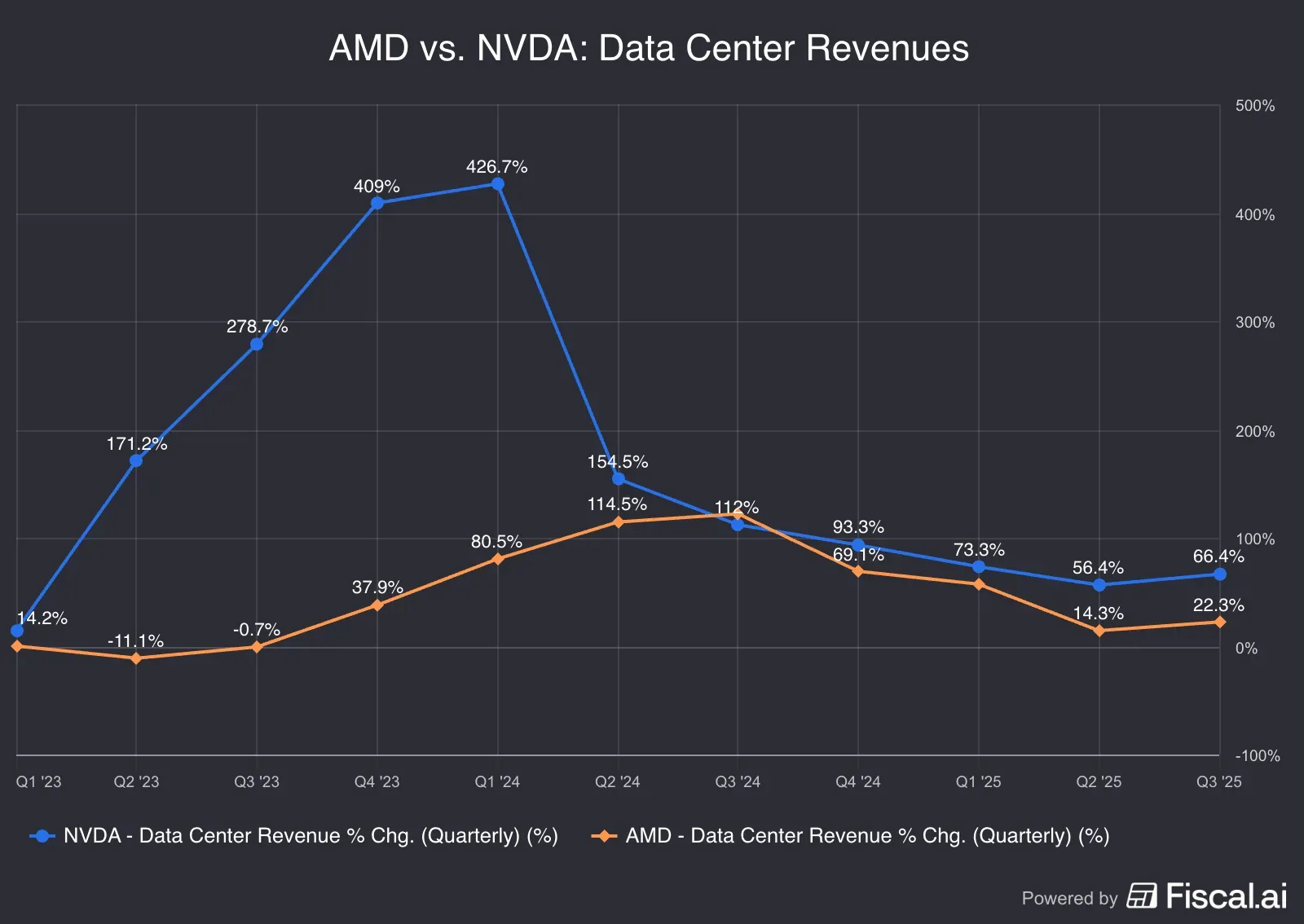

Nvidia still rules the roost in the data center market, with revenue totaling $51.2 billion in the third quarter compared to AMD’s tally of $4.3 billion. The YoY data center revenue growth pace was 66% for Nvidia and 22% for AMD in the third quarter, up from 56.4% and 14.3%, respectively, in the preceding quarter.

Looking at the rate of change, AMD’s growth pace has increased by two-thirds, while NVDA’s has grown by less than one-fifth.

Source: Fiscal.ai<

Each new AI dollar spent now doesn’t go exclusively to Nvidia, and it is forced to share the AI accelerator pie with competition. Since AMD is growing off a smaller revenue base, even small wins can help it record outsized percentage growth. The incremental AI revenue AMD earns could give it additional operating leverage — i.e., profit growth per additional dollar of revenue will be high once fixed costs are covered.

Incidentally, AMD’s data center comprises EPYC server processors designed for AI workloads in large data centers, and its AMD Instinct GPU accelerators are intended for high-performance computing (HPC) and AI workloads. On the other hand, Nvidia’s data center business is designed to offer a full-stack, integrated AI platform, including specialized hardware (GPUs & CPUs), networking, and software.

2. AMD’s Inferencing Superiority

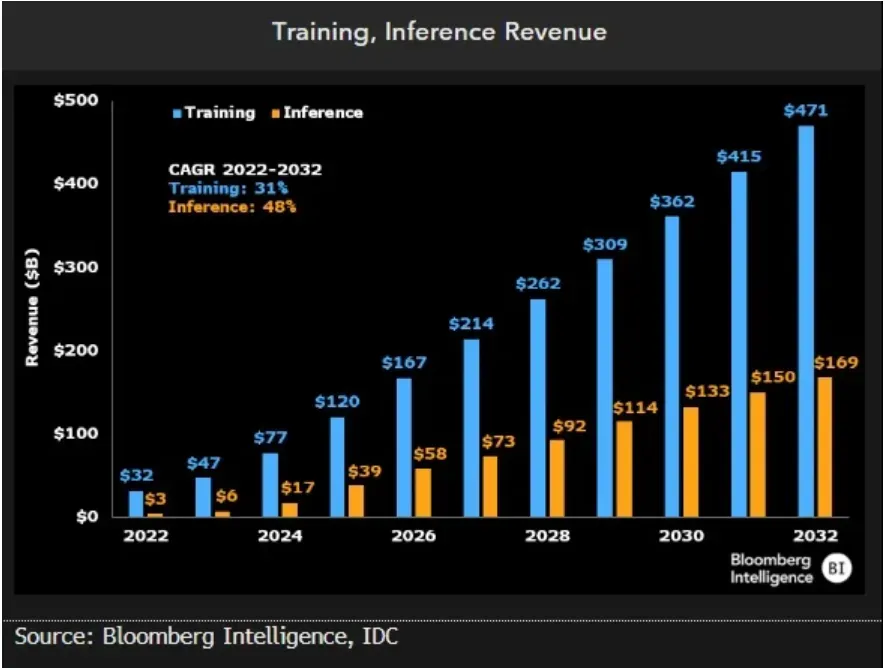

AMD has a competitive edge in the AI inferencing chip market, which is set to grow at a compounded annual growth rate (CAGR) of 48%, compared to 31% for training. Inferencing is the process of running live data through a trained AI model to conclude brand new data.

Source: Bloomberg<

AMD’s MI355X, launched in June, outperforms the Nvidia B200 AI accelerator in both memory capacity and bandwidth. Sharing a chart from third-party benchmark Signal65, tech-focused blogger and investor Daniel Romero said the MI355X outperformed on several metrics, including throughout and published results, vis-a-vis the B200, while being used for inderencing in the DeepSeek-R1 model.

Source: Signal65 via X<

3. AMD vs. NVDA: Which Is More Affordable?

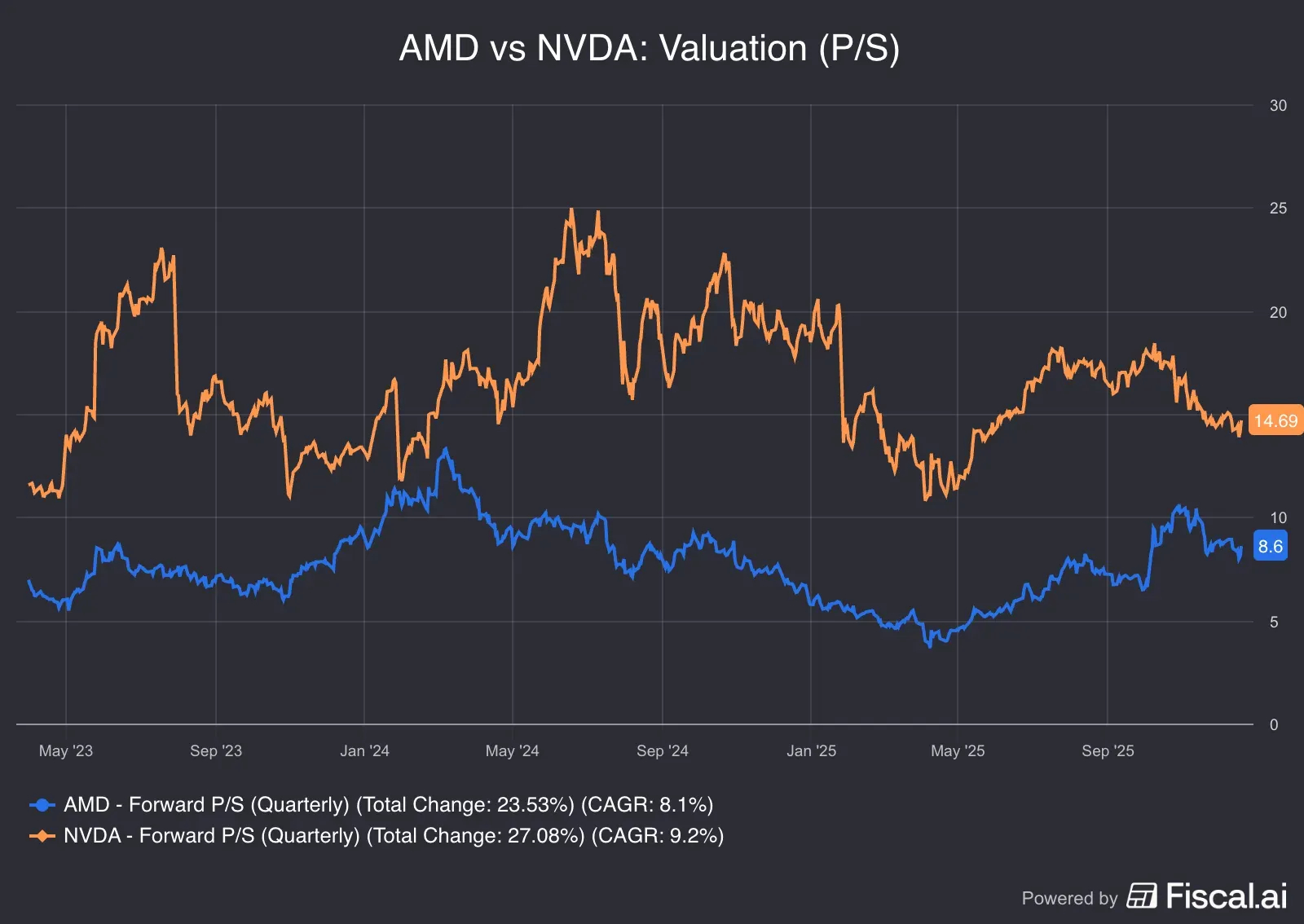

Although AMD has a higher forward price-earnings (P/E) multiple versus Nvidia, on a price-sales (P/S) basis, AMD appears cheaper.

Source: Fiscal.ai<

AMD vs. NVDA: Retail’s Verdict

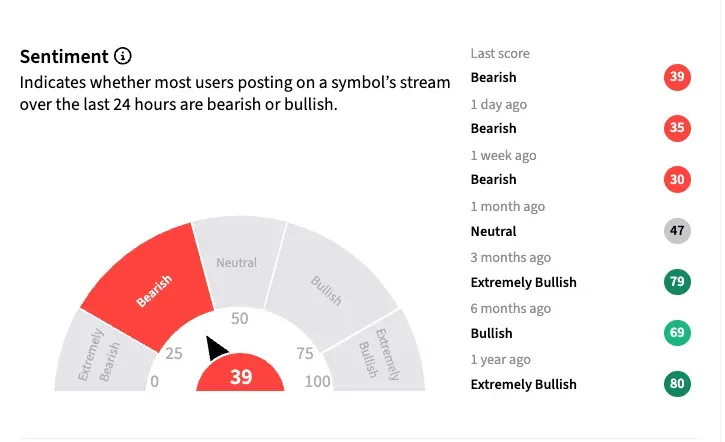

Retail investors are equally pessimistic toward AMD and Nvidia shares. On Stocktwits, retail sentiment toward AMD, which was largely ‘bullish’ for much of the year, has worsened to ‘bearish’ since last week.

Nvidia’s stock has seen retail sentiment fluctuating from ‘extremely bullish’ to ‘extremely bearish’ this year, with the mood currently at ‘bearish.’

AMD vs. NVDA: The Outlook

The potential resumption of AI chip sales to China bodes well for both companies. With the Trump administration’s renewed China chip ban announced in April, both AMD and Nvidia suffered a setback, as the workaround AI chips they developed to sidestep the ban imposed by the previous Biden administration were blocked. According to a Saxo report, Nvidia earned roughly $17 billion in revenue from China in 2024, while AMD earned $6.2 billion. High-value AI accelerators accounted for the bulk of the shipments.

AMD has secured major contracts to deploy data center chips, including with OpenAI, as the AI startup diversifies its supplier base. A media report suggested that Alibaba is considering buying 40,000 to 50,000 units of AMD’s MI308 accelerators.

Another significant overhang for AI plays has been the use of circular financing structures, which have fueled skepticism about how much of the announced demand reflects genuine end-customer spending. AMD is relatively insulated as the deals are structured more as investments than financing. The OpenAI deal announced in October calls for giving it a potential 10% equity stake in AMD through warrants tied to chip sales.

AMD and Broadcom may be on track to develop AI processor revenue slightly faster than Nvidia in 2026, Morgan Stanley said in a report released earlier this month. The firm, however, sees the lag as a function of supply chain constraints of a $205 billion run-rate revenue stream. At AMD’s Financial Analyst Day, AMD CEO Lisa Su said:

“With the broadest portfolio of products and our deepening strategic partnerships, AMD is uniquely positioned to lead the next generation of high-performance and AI computing.”

AMD said it expects to lead the AI compute market, which is estimated at $1 trillion by 2030, with a 40% CAGR, compared to its $500 billion estimate for 2028. The company expects its AI data center revenue to grow at an 80% CAGR over the next 3-5 years, driven by strong momentum across multiple hyperscaler, AI-native, and sovereign opportunities.

Wall Street analysts currently see more upside for Nvidia stock over the next year than for AMD, according to price targets compiled by Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<