Piper Sandler cited softer cryptocurrency trading volumes, the end of the football season weighing on prediction market revenue, and rising doubts about the momentum of retail trading as reasons for the downtrend.

- The brokerage maintained an ‘Overweight’ rating and kept the stock’s price target at $155, implying a potential 70% upside from current levels.

- Piper Sandler added that Robinhood is the closest fintech platform it has seen to reaching “super app” status

- HOOD shares fell below their 200-day moving average last week for the first time since April 2025.

Shares of Robinhood Markets Inc. (HOOD) slumped 9% on Monday, extending declines into the fifth session, while falling to its lowest levels since July 2025.

HOOD shares fell below their 200-day moving average (200-DMA) last week for the first time since April 2025.

Source: Trading View

Piper Sandler maintained an ‘Overweight’ rating on the stock and kept its price target at $155, implying a potential 70% upside from the current price of $91.3, according to Investing.com.

Near-Term Risks

Piper Sandler flagged three near-term risks for Robinhood’s stock, including softer cryptocurrency trading volumes amid falling token prices, the end of football season weighing on prediction market revenue, and rising doubts about the durability of recent retail trading momentum. The firm also highlighted the stock’s high beta of 2.45, which makes it more volatile than the broader market.

However, the brokerage remains bullish on Robinhood’s long-term prospects, calling it the “best investment option” to benefit from the secular growth in retail trading. Piper Sandler added that Robinhood is the closest fintech platform it has seen to reaching “super app” status.

Robinhood shares hit a record $152.46 last October but have since fallen roughly 40%, including a more than 20% drop in January. The stock is also under pressure from weakening Bitcoin prices, which are down about 10% so far this year.

Latest Developments

Bloomberg reported last week that the U.S. federal government is considering Robinhood for a key role overseeing the new “Trump accounts” for millions of children. The company has reportedly begun internal preparations in case it is chosen as a trustee, a move that could bring billions in new assets.

Separately, Robinhood is reportedly pursuing a role in the SpaceX IPO, potentially offering shares to retail investors through its IPO Access platform.

What Are Stocktwits Users Saying?

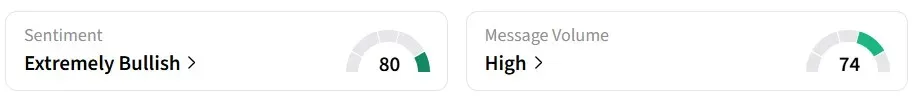

Retail sentiment on Stocktwits changed to ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘high’ message volumes. According to platform data, retail chatter about the stock increased by more than 95% over the past 24 hours.

One bullish user noted HOOD’s declining crypto revenue stream.

Another user identified a buying opportunity, noting that the bottom might be near.

Read also: Why Did AQST Stock Jump 35% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<