Spot gold climbed 5.1% higher to $4,902 an ounce, while spot silver shot up nearly 10% to $86.8 an ounce.

- Gold futures for March 2026 deliveries jumped 5.9% to $4,912 an ounce, and silver futures for March 2026 deliveries surged more than 12% to $86.8 per ounce.

- The selloff reset sentiment, and gold could reach $7,500 and silver $300 an ounce by the summer of 2026, an analyst said.

- DXY inched 0.1% lower to 97.5 in pre-market trading.

Gold and silver prices surged on Tuesday, lifting mining stocks, as the precious metals staged a sharp rebound after a three-session rout that sent shockwaves across commodity markets.

Spot gold (XAU/USD) prices climbed 5.1% higher to $4,902 an ounce after falling nearly 14% over the past three sessions. Gold futures for March 2026 deliveries jumped 5.9% to $4,912 an ounce at the time of writing.

Spot silver (XAG/USD), which shed around 32% in the past three sessions, shot up nearly 9.5% to $86.8 an ounce. Silver futures for March 2026 deliveries surged 12.8% to $86.8 per ounce.

Precious metals saw sharp declines after President Donald Trump nominated former Fed governor Kevin Warsh as the next Federal Reserve chair on Friday.

Meanwhile, the DXY index, which measures the greenback against six major currencies, inched 0.1% lower to 97.5 in pre-market trading on Tuesday.

What Did Analysts Say?

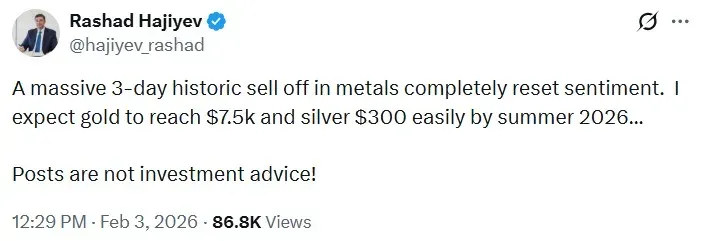

In a post on X on Tuesday, Rashad Hajiyev, founder of RM Capital Consulting, said that the selloff reset sentiment and expects gold to reach $7,500 and silver $300 an ounce by the summer of 2026.

How Did Stocktwits Users React?

Shares of silver miners, including First Majestic (AG) and Hecla Mining (HL), and Pan American Silver Corp. (PAAS) were up around 5% each after the opening bell. Shares of gold miners Newmont Corp. (NEM) gained 4% while Barrick Gold (B) rose more than 5%.

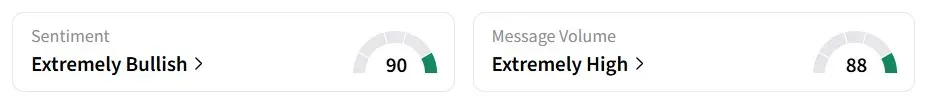

Meanwhile, retail sentiment for iShares Silver Trust (SLV) and SPDR Gold Shares ETF (GLD) remained in the ‘extremely bullish’ territory, amid ‘extremely high’ message volumes.’

One Stocktwits user suggested further accumulation of SLV as supply is likely to tighten over time, driving prices higher.

Another user expects GLD to climb to $500 by the end of February. It is currently trading at around $452.

Read also: ZENA Stock Gained In Pre-Market Today – What Is The New DaaS Deal About?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<