GE Vernova expects revenue to reach $52 billion by 2028, up from its earlier forecast of $45 billion, along with a higher adjusted EBITDA margin of 20%.

- GE Vernova is working with the U.S. government to expand stockpiles of yttrium, a critical rare earth metal, Reuters reported.

- The company increased its share repurchase authorization to $10 billion from $6 billion.

- JPMorgan raised GE Vernova’s target price to $1,000 from $740 and maintained an ‘Overweight’ rating.

Shares of GE Vernova Inc. (GEV) jumped as much as 17% to a record high on Wednesday after the company raised its FY2028 revenue and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin targets, while also revealing that it is working with the U.S. government to boost rare earth stockpiles.

GEV was among the top-trending tickers on Stocktwits on Wednesday morning.

2028 Revenue Guidance

At its 2025 Investor Update in New York, GE Vernova raised its long-term financial targets, highlighting what CEO Scott Strazik called “the early chapters of an incredible value-creation opportunity.”

The company now expects revenue to reach $52 billion by 2028, up from its earlier forecast of $45 billion, along with a significantly higher EBITDA margin of 20%. GE Vernova also anticipates generating at least $22 billion in cumulative free cash flow from 2025 to 2028, well above its prior expectations of $14 billion.

The company reaffirmed its 2025 financial guidance and introduced 2026 forecasts, calling for up to $42 billion in revenue next year and adjusted EBITDA margins of up to 13%. The Board also doubled the quarterly dividend to $0.50 per share and increased the share repurchase authorization to $10 billion from $6 billion.

Expanding Yttrium Stockpiles

GE Vernova is working with the U.S. government to expand stockpiles of yttrium, a critical rare earth metal facing severe global shortages, according to a Reuters report on Wednesday. Strazik said the company has secured enough yttrium to last through 2025 and into 2026, but is continuing to build inventory as China’s export restrictions tighten supplies for the energy, aerospace, and semiconductor sectors.

What Did Analysts Say?

JPMorgan raised GE Vernova’s target price to $1,000 from $740 and maintained an ‘Overweight’ rating, according to TheFly. The company’s “by 2028” financial targets were stronger than expected for the core Power and Electrification segments, with multiple paths to upside. GE Vernova's Power order activity in Q4 significantly exceeded expectations, JPMorgan added.

RBC Capital upgraded GE Vernova to ‘Outperform’ from ‘Sector Perform’ and lifted its price target to $761 from $630, citing the company’s strengthened medium-term outlook. In a note to investors, the firm said its earlier downgrade underestimated GE Vernova’s accelerating growth and margin potential, which continue to improve through stronger equipment margins and ongoing productivity gains.

RBC added that the stock’s recent multiple expansion signals growing confidence that earnings estimates may continue to move higher.

How Did Stocktwits Users React?

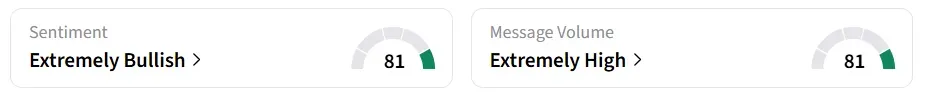

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a day earlier, accompanied by ‘extremely high’ message volumes.

One user highlighted the company’s growth.

Year-to-date, the stock has gained more than 115%.

Read also: Silver Price Surges To Fresh Highs Ahead Of Fed Decision Later Today

For updates and corrections, email newsroom[at]stocktwits[dot]com.<